Working Capital

We were able to reduce our working capital by 15.2% from € 549.4 million last year to € 465.8 million as of December 31, 2020. Inventories increased only slightly by 2.5% from € 1,110.2 million to € 1,138.0 million as a result of disciplined buying and good inventory management. Trade receivables increased only slightly by 1.5% from € 611.7 million to € 621.0 million. On the liabilities side, trade payables increased by 11.6% from € 843.7 million to € 941.5 million due to extended payment terms agreed with our suppliers.

Cash Flow and Liquidity Situation

The free cash flow declined from € 330.0 million in 2019 to € 276.0 million in 2020. The decline in 2020 was caused by the drop of earnings before taxes, while improved working capital and lower tax payments as well as lower capital expenditures had a positive impact.

As of December 31, 2020, PUMA’s cash position amounted to € 655.9 million compared to € 518.1 million last year. In addition, the PUMA Group had credit lines totaling € 1,639.1 million available as of December 31, 2020 (last year: € 687.6 million). Unused credit lines amounted to € 1,372.7 million as of the balance sheet date compared to € 514.1 million last year.

In line with our strategic priorities in dealing with the COVID-19 pandemic, we obtained an additional credit line in May 2020 to ensure the financial liquidity of the PUMA Group. This credit line served as an insurance to guarantee sufficient liquidity in a time of unprecedented crisis and uncertainty regarding the duration and impact of the COVID-19 pandemic. The additional syndicated credit line of € 900 million from twelve banks, including a direct commitment from Kreditanstalt für Wiederaufbau (KfW), was already reduced by € 700 million to € 200 million as of December 31, 2020. PUMA refinanced this syndicated credit facility in December 2020 by securing a new promissory note loan of € 250 million and increasing existing credit lines with banks by € 450 million.

Events after the balance sheet date

On February 1, 2021, PUMA terminated the remaining syndicated credit facility of € 200 million from twelve banks including KfW. This could be achieved due to PUMA’s financial strength and the increase of other credit facilities as described above.

Proposal of a Dividend of € 0.16 per share

Based on the positive net earnings in 2020, the Management Board and Supervisory Board will propose to the Annual General Meeting on May 5, 2021 to distribute a dividend of € 0.16 per share for the financial year 2020. The payout ratio for the financial year 2020 is 30.3% of the consolidated net earnings and is in line with PUMA SE's dividend policy, which provides for a payout ratio of 25% to 35% of consolidated net earnings. However, the payout is conditional on an overall sound macroeconomic environment.

Brand and Strategy Update

The COVID-19 pandemic presented PUMA with several challenges which affected different parts of our business throughout 2020. We reacted quickly and decisively to these challenges with our mantra being to survive and manage the crisis short-term without hindering our mid-term momentum. In the short-term, our main priority was to ensure the health and safety of our people, mitigate the sales impact wherever possible, secure the supply chain and ensure sufficient financial liquidity and manage costs. At the same time, we continued to invest in the mid- and long-term future of our company.

Therefore, we focused on our six existing strategic priorities: create brand heat, design, develop and produce market-leading product ranges that are right for our consumers, build a comprehensive offer for women, improve the quality of our distribution, increase the speed and efficiency of our organizational infrastructure and strengthen our positioning in the North American market by leveraging our re-entry into the Basketball category. In 2020, we added two further strategic priorities: an even stronger focus on local relevance and increased communication around our long-standing activities in the area of sustainability.

To ensure continued brand heat and momentum in 2020, we invested in strong product ranges for the upcoming seasons and several new athletes, teams and brand ambassadors.

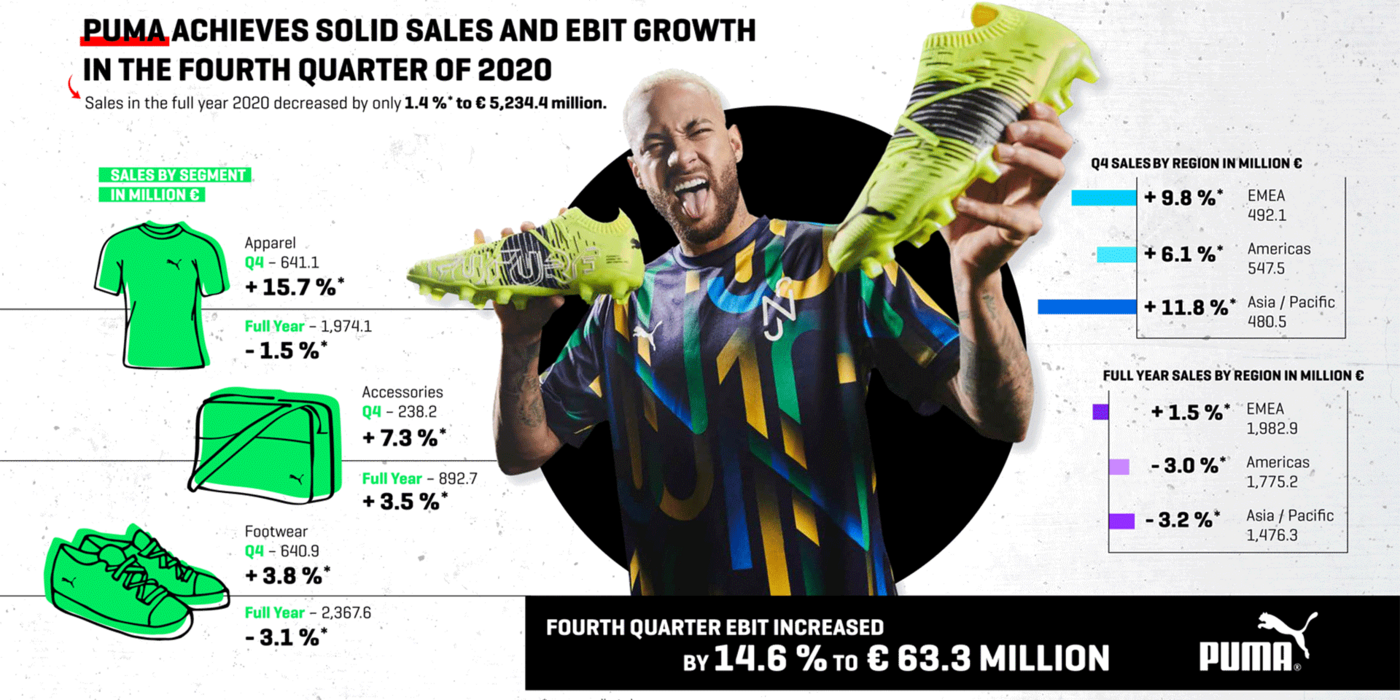

A major highlight within our Teamsport category was the new long-term partnership with football star Neymar Jr., one of the most successful and influential players of his generation.

Neymar Jr. has won several trophies in Brazil, Spain and France as well as the Champions League™ and the Copa Libertadores™. He also won the Olympic Gold Medal with the Brazilian National Team in 2016. He has scored 64 goals in 103 matches for Brazil, making him the second best goal scorer in the history of the Brazilian national team just behind another legendary PUMA player: Pelé. The addition of Neymar Jr. to our roster of world-class assets underlines our continued focus on the football category. Neymar Jr. played his first match in the PUMA KING football boot, which was also worn by PUMA football legends Pelé, Cruyff and Maradona. Neymar Jr. now plays in the newly launched PUMA FUTURE Z 1.1 football boot, which will be also worn by PUMA players James Maddison, Marco Reus and Dzsenifer Marozsán. PUMA continued to grow its portfolio of world-class football teams by signing Dutch club PSV Eindhoven, Ukrainian club Shakhtar Donetsk as well as the national federations of Iceland and Paraguay. In 2020, we also launched the revolutionary PUMA ULTRA football boot, which is worn on-pitch by players like Antoine Griezmann, Sergio Agüero, Harry Maguire and Eugénie Le Sommer and received great feedback from retailers and consumers.

Our Running and Training category benefited from the extraordinary performance of our track and field athletes and the introduction of innovative products.PUMA athlete Armand "Mondo" Duplantis entered the history books by setting a new world record in pole vault. He cleared 6.18 meters at an indoor event in February 2020 and broke the 26-year-old outdoor record by jumping 6.15 meters in September.

To support PUMA’s positioning in track and field, we signed a partnership with the Australian and South African Athletics Federations. PUMA has also signed Jamaican athletes Tajay Gayle, the long-jump World Champion, as well as Omar McLeod, the reigning Olympic Champion in 110m hurdles and the 2017 World Champion over the same distance.

In performance footwear, we keep on moving forward with innovative running & training shoes based on our proprietary NITRO, HYBRID and XETIC technology platforms. We also signed world-leading long distance runners such as Molly Seidel to underline our new ambitions in performance running.

2020 was also a successful year for PUMA’s Golf business which continued to be an important pillar among our performance categories. Especially our innovative COBRA Golf SPEEDZONE drivers and the one length irons enjoyed great popularity throughout the year. Supported by his COBRA Golf equipment, PUMA player Bryson DeChambeau won the U.S. Open.

In Motorsport, PUMA brand ambassador Lewis Hamilton became Formula 1 World Champion for the seventh time, equaling Michael Schumacher's existing record. Among launches of limited SPEEDCAT editions in 2020, PUMA introduced a dedicated women’s collection with the launch of the Mercedes-AMG Petronas F1 Team SPEEDCAT Mid L. The shoe is a great and stylish example of PUMA’s ambition to support gender equality in motorsport.

Creating a leading product offer for women remains a priority for PUMA and we continue our mission to be the most fashion-forward sports brand for the female consumer. In 2020, we evolved our positioning of “PUMA owns the space where the gym meets the runway”, as more and more women take up sports worldwide and athletic wear has long made its way into everyday outfits. We welcomed English singer and songwriter Dua Lipa as our newest women’s brand ambassador, who will appear in important campaigns for the brand in the new year. Canadian model Winnie Harlow joined the PUMA family in early 2020, and already featured in the marketing campaigns for several new footwear styles, including the KYRON and the MILE RIDER. Our existing key footwear franchises such as the PUMA CALI continued to resonate well with the female consumer and showed strong sell-through.

Our return to Basketball was an important step towards increasing our credibility as a sports brand in North America. With the support of JAY-Z, our creative director for Basketball, we continued to develop a strong product offering across Footwear, Apparel and Accessories that resonated well on and off the court. We also signed a multi-year partnership with Grammy-winning artist J. Cole, with whom we developed and launched the basketball shoe RS-DREAMER that sold out immediately. Later in the year, we announced a new partnership with creative director June Ambrose, who will create girls and women’s collections for PUMA Basketball as of 2021. We continued to work with highly talented NBA players and gained great on-court visibility when PUMA players Kyle Kuzma and Danny Green won this year’s NBA Championship with the Los Angeles Lakers. Signing a long-term partnership with LaMelo Ball, one of the top picks of the 2020 NBA draft, further underlines our commitment to the sport. Our Basketball business is also growing beyond the key North American market, with strong sales of our performance basketball product portfolio and basketball-inspired Sportstyle product families such as the RALPH SAMPSON.

While Basketball is especially important for North America, we also focused on ensuring strong local relevance in all our other markets around the world. As the PUMA brand and products continue to resonate well around the world, we see an increased need to focus on the sports, ambassadors, influencers, collaboration partners and communication platforms that are most relevant in the different markets. A good example is India, where we have a market-leading position in part due to our strong presence in the nation’s most popular sport, cricket, and our long-term partnership with Virat Kohli, the captain of the Indian national cricket team.

PUMA continued to improve the quality of distribution by expanding its presence in key sports performance and sportstyle accounts around the world. We were able to strengthen the relationships with our retailers by being a flexible and service-oriented business partner also throughout the COVID-19 pandemic. In parallel, we invested in our direct-to-consumer business, which includes our owned-and-operated retail stores as well as our e-commerce business. During 2020, we saw strong growth in our e-commerce business and invested in our respective front-end and back-end capabilities as well as performance marketing to drive traffic and conversion.

In sourcing, we worked very closely with all our suppliers throughout 2020 and supported each other wherever possible to mitigate the negative consequences of the COVID-19 pandemic. The strong partnership with our suppliers has helped us tremendously in a challenging environment and contributed to a very resilient supply chain situation in 2020. It also enabled us to avoid nearly any disruptions in the delivery of products to our retail partners and consumers around the world. We cancelled very few (less than 1%) orders and we paid our suppliers the costs for those orders we cancelled. The long-term collaboration with our suppliers proved to be indispensable in 2020 and will continue to be a key component of our strategy.

On the operational side, we made good progress with the upgrade of our logistics network in order to support our overall growth ambitions. In 2020, we opened our new highly automated multi-channel distribution center in Indianapolis, USA, which will speed up delivery times in the US. In Europe, we continued to work on our multi-channel distribution center in Geiselwind, Germany, which is expected to be operational in the second quarter of 2021. In addition, we worked on multiple other distribution center projects around the world.

While social, economic and environmental sustainability has always been a core value for PUMA, we wanted to place an even higher strategic emphasis on this topic with a special focus on increasing the number of sustainable products in our ranges and stronger consumer-facing communication. In 2020, we officially announced our 10FOR25 targets which outline our ambitious sustainability-related objectives until 2025 and are linked to the United Nation’s Sustainable Development Goals. We also launched our FOREVER BETTER communication platform, which we will use to communicate our sustainability programs to consumers. In 2020, we presented two collections with a sustainability focus, which received strong feedback from our retailers and end consumers: PUMA x FIRST MILE and PUMA x CENTRAL SAINT MARTINS.

Outlook 2021

Our sales and profitability rebounded strongly in the third quarter of 2020 after a very weak second quarter, which was severely impacted by the COVID-19 pandemic. Given this strong rebound, we anticipated that 2021 would become what 2020 was initially supposed to be: a year characterized by double-digit sales growth compared to the 2019 baseline and a strong improvement in our operating result (EBIT) driven by a slight improvement in our gross profit margin and operational leverage (2019 EBIT: € 440.2 million).

However, as the number of COVID-19 cases continues to be on a very high level globally, several governments have already extended their lockdowns until end of February or even into March. As of today, approximately 50% of the retail stores selling our products in Europe are still closed due to various lockdown measures. Also in multiple other markets the retail stores remain closed or are operating with significant restrictions. By consequence, a part of our business in 2021 will be once again negatively impacted by the COVID-19 pandemic despite a strong orderbook and high demand from our retail partners and consumers.

We will continue to mitigate the consequences of the COVID-19 pandemic wherever possible but foresee a negative impact on our business especially in the first half of 2021. We currently believe that the first quarter and also the beginning of the second quarter will be heavily impacted. However, we believe that we will see a recovery until the end of the second quarter and strong improvements throughout the third and fourth quarter. Given that vaccination campaigns are already under way in almost all parts of the world, we remain confident especially for the second half of 2021. For the full year 2021 we therefore expect at least a moderate increase in sales in constant currency – with an upside potential – (2020: € 5,234.4 million) and both, our operating result (EBIT 2020: € 209.2 million) and net earnings (2020: € 78.9 million) will show a significant improvement compared to 2020. The development of our gross profit margin and our OPEX-ratio for 2021 will depend on the degree and duration of the negative impact of the COVID-19 pandemic on our sales.

Our quick recovery in the third quarter and the beginning of the fourth quarter of 2020 and our strong orderbook for the year 2021 combined with very good feedback from retail partners and consumers around the world make us confident for the mid-term success and growth of PUMA.