Corporate Governance

Corporate Governance at PUMA SE

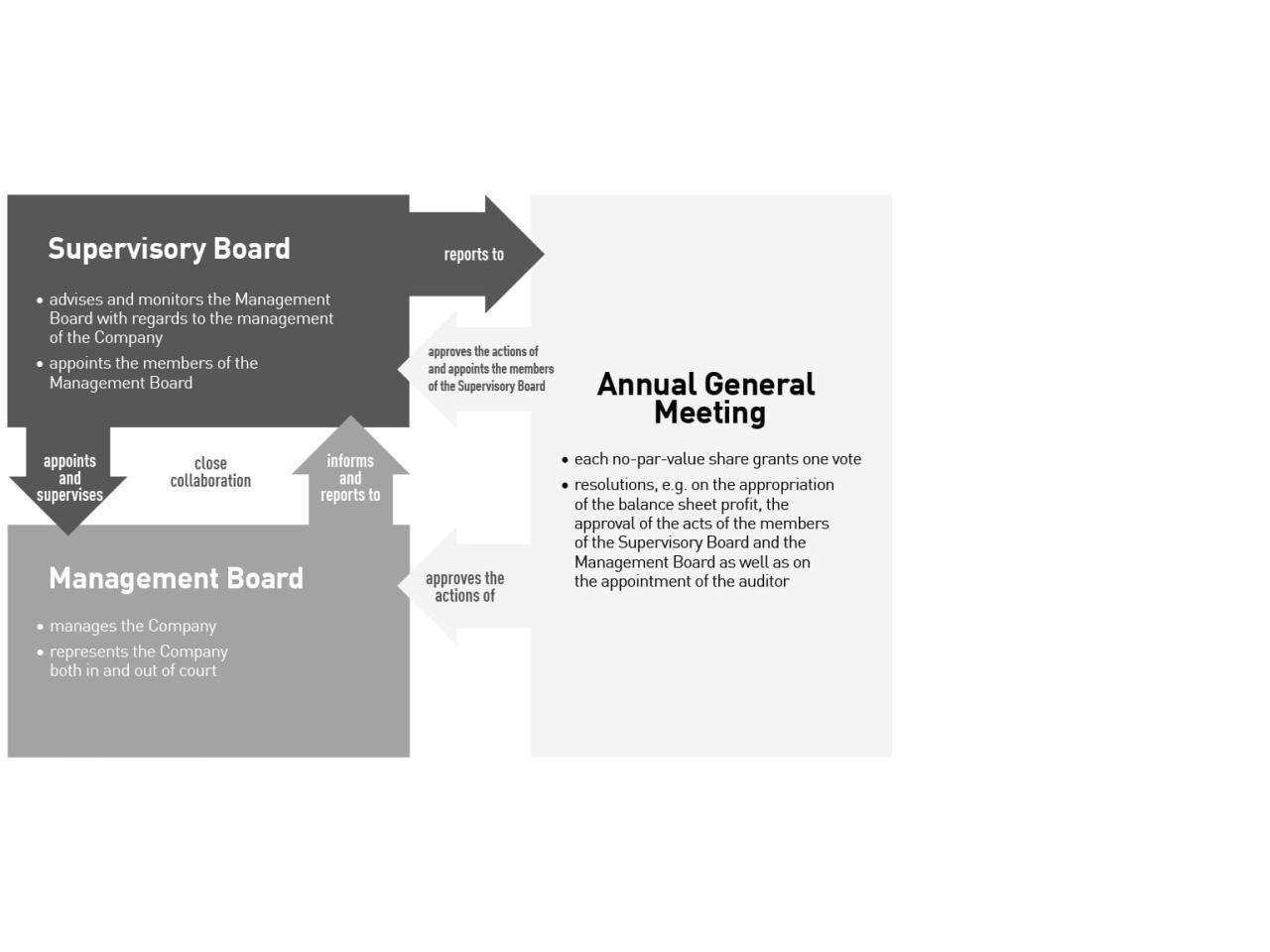

The effective implementation of corporate governance principles is an important aspect of PUMA’s corporate policy. Transparent and responsible corporate governance is a prerequisite for achieving corporate targets and for increasing the Company’s value in a sustainable manner. The Supervisory Board and the Management Board work closely with each other in the interests of the entire Company so that the Company is managed and monitored in an efficient way ensuring sustainable added value through good corporate governance.

Corporate Governance System

PUMA SE has a dual management and supervisory structure. The Management Board is composed of five members. The Supervisory Board is composed of seven members, five of whom are elected by the Annual General Meeting and two of whom are elected by the employees. Another important corporate body is the meeting of the shareholders.

German Corporate Governance Code

Management Board

Arthur Hoeld

Chief Executive Officer

Maria Valdes

Chief Brand Officer

Markus Neubrand

Chief Financial Officer

Matthias Baeumer

Chief Commercial Officer

ANDREAS HUBERT

CHIEF OPERATING OFFICER

Supervisory Board

Héloïse Temple-Boyer

Chair of the Supervisory Board

Jean-Marc Duplaix

Deputy Chair of the Supervisory Board and Chair of the Audit Committee

Harsh Saini

Chair of the Sustainability Committee

Roland Krueger

Chair of the Nominating Committee

Fiona May OLY

Shareholders' Representative

Martin Koeppel

Employees' Representative

Bernd Illig

Employees' Representative

Statements of Compliance in accordance with §161 of the German Stock Corporation Act (AktG):

Articles of Association

(Convenience translation)

PUMA SE (the “Company, together with its affiliates according to Sections 15 et. seq. German Stock Corporation Act (Aktiengesetz, AktG), the “PUMA Group”) has a dualistic management and supervisory system consisting of a management body (the “Management Board”) and a supervisory body (the “Supervisory Board”) according to Art. 38 lit. b) alternative 1, Art. 39, Art. 40 of the Council Regulation (EC) No. 2157/2001 of 8 October 2001 on the Statute of a European Company (SE) (the “SE‐VO”):

(Convenience translation)

PUMA SE (the “Company, together with its affiliates according to Sections 15 et. seq. German Stock Corporation Act (Aktiengesetz, AktG), the “PUMA Group”) has a dualistic management and supervisory system consisting of a management body (the “Management Board”) and a supervisory body (the “Supervisory Board”) according to Art. 38 lit. b) alternative 1, Art. 39, Art. 40 of the Council Regulation (EC) No. 2157/2001 of 8 October 2001 on the Statute of a European Company (SE) (the “SE‐VO”):

Information concerning takeovers 2024

The following information, valid December 31, 2024, is presented in accordance with Art. 9 p. 1 c) (ii) of the SE Regulation in conjunction with Sections 289a, 315a German Commercial Code (HGB). Details under Sections 289a, 315a HGB which do not apply at PUMA SE are not mentioned.

Composition of the subscribed capital (Sections 289a [1][1], 315a [1][1] HGB)

On the balance sheet date, subscribed capital totaled € 149,698,196.00 and was divided into 149,698,196 no-par value shares with a proportional amount in the statutory capital of € 1.00 per share. As of the balance sheet date, the Company held 873.783 treasury shares.

Shareholdings exceeding 10% of the voting rights (Sections 289a [1][3], 315a [1][3] HGB)

As of December 31, 2024, there was one shareholding in PUMA SE that exceeded 10% of the voting rights. It was held by the Pinault family via several companies controlled by them (ranked by size of stake held by the Pinault family: Financière Pinault S.C.A., Artémis S.A.S. and Kering S.A.). The shareholding of Kering S.A. in PUMA SE amounted to 0.0% of the share capital on December 31, 2024, according to Kering’s own information. The shareholding of Artémis S.A.S. amounted to 28.7% of the share capital on December 31, 2024 (after the capital reduction resulting from the share buy-back program).

Statutory provisions and regulations of the Articles of Association on the appointment and

dismissal of the members of the Management Board and on amendments to the Articles of Association (Sections 289a [1][6], 315a [1][6] HGB)

Regarding the appointment and dismissal of the members of the Management Board, reference is made to the applicable statutory requirements of § 84 German Stock Corporation Act (AktG). Moreover, Section 7[1] of PUMA SE’s Articles of Association stipulates that Management Board shall consist of two members in the minimum; the Supervisory Board determines the number of members in the Management Board. The Supervisory Board may appoint deputy members of the Management Board and appoint a member of the Management Board as chairperson of the Management Board. Members of the Management Board may be dismissed only for good cause, within the meaning of Section 84[3] of the AktG or if the employment agreement is terminated, for which in each case a resolution must be adopted by the Supervisory Board with a simple majority of the votes cast.

Amendments to the Articles of Association of the Company require a resolution by the Annual General Meeting. Resolutions of the Annual General Meeting require a majority according to Art. 59 SE Regulation and Sections 133[1], 179 [2] [1] AktG (i.e. a simple majority of votes and a majority of at least three quarters of the share capital represented at the time the resolution is adopted). The Company has not made use of Section 51 SEAG.

Authority of the Management Board to issue or repurchase shares (Sections 289a [1][7], 315a [1][7] HGB)

The authority of the Management Board to issue shares result from Section 4 of the Articles of Association and from the statutory provisions:

Authorized Capital

By resolution of the Annual General Meeting on May 5, 2021, the Management Board is authorized, with approval of the Supervisory Board, to increase the share capital of the Company by up to EUR 30,000,000.00 by issuing, once or several times, new no par-value bearer shares against contributions in cash and/or kind until 4 May 2026 (Authorized Capital 2021). In case of capital increases against contributions in cash, the new shares may be acquired by one or several banks, designated by the Management Board, subject to the obligation to offer them to the shareholders for subscription (indirect pre-emption right).

The shareholders shall generally be entitled to pre-emption rights. However, the Management Board shall be authorized with approval of the Supervisory Board, to partially or completely exclude pre-emption rights

to avoid peak amounts;

in case of capital increases against contributions in cash if the pro-rated amount of the share capital attributable to the new shares for which pre-emption rights have been excluded does not exceed 10% of the share capital and the issue price of the newly created shares is not significantly lower than the relevant exchange price for already listed shares of the same class, Section 186 (3) sentence 4 of the German Stock Corporation Act (Aktiengesetz, AktG). The 10% limit of the share capital shall apply at the time of the resolution on this authorization by the Annual General Meeting as well as at the time of exercise of the authorization. Shares of the Company (i) which are issued or sold during the term of the Authorized Capital 2021 excluding shareholders’ pre-emption rights directly or respectively applying Section 186 (3) sentence 4 AktG or (ii) which are or can be issued to service option and convertible bonds applying Section 186 (3) sentence 4 AktG while excluding shareholders’ pre-emption rights during the term of the Authorized Capital 2021, shall be counted towards said limit of 10%;

in case of capital increases against contributions in cash insofar as it is required to grant pre-emption rights regarding the Company’s shares to holders of option or convertible bonds which have been or will be issued by the Company or its direct or indirect subsidiaries to such an extent to which they would be entitled after exercising option or conversion rights or fulfilling the conversion obligation as a shareholder;

in case of capital increases against contributions in kind for carrying out mergers or for the direct or indirect acquisition of companies, participation in companies or parts of companies or other assets including intellectual property rights and receivables against the Company or any companies controlled by it in the sense of Section 17 AktG.

The total amount of shares issued or to be issued based upon this authorization while excluding shareholders’ pre-emption rights may neither exceed 10% of the share capital at the time of the authorization becoming effective nor at the time of exercising the authorization; this limit must include all shares which have been disposed of or issued or are to be issued during the term of this authorization based on other authorizations while excluding pre-emption rights or which are to be issued because of an issue of option or convertible bonds during the term of this authorization while excluding pre-emption rights. The Management Board shall be entitled, with approval of the Supervisory Board, to determine the remaining terms of the rights associated with the new shares as well as the conditions of the issuance of shares. The Supervisory Board is entitled to adjust the respective version of the Company’s Articles of Association with regard to the respective use of the Authorized Capital 2021 and after the expiration of the authorization period.

The Management Board of PUMA SE did not make use of the existing Authorized Capital in the current reporting period.

Conditional Capital

The Annual General Meeting of May 11, 2022 has authorized the Management Board until May 10, 2027 with the approval of the Supervisory Board to issue once or several times, in whole or in part, and at the same time in different tranches bearer and/or registered convertible bonds and/or options and profit-participation rights and/or profit bonds or combinations thereof with or without maturity restrictions in the total nominal amount of up to € 1,500,000,000.00.

The share capital is conditionally increased by up to € 15,082,464.00 by issue of up to 15,082,464 new no-par value bearer shares (Conditional Capital 2022). The conditional capital increase shall only be implemented to the extent that conversion/option rights are exercised, or the conversion/option obligations are performed, or tenders are carried out and to the extent that other forms of performance are not applied.

No use has been made of this authorization to date.

Authorization to acquire treasury shares

The Annual General Meeting of May 7, 2020 resolved under agenda item 6 to authorize PUMA SE to acquire and utilize treasury shares until May 6, 2025, including the authorization to sell treasury shares while excluding shareholders' pre-emption rights and the authorization to offer and transfer treasury shares to third parties against non-cash consideration. The authorization from 2020 was extended by resolution of the Annual General Meeting on May 5, 2021 to the effect that the Supervisory Board was authorized to issue treasury shares to members of the Management Board as a component of Management Board remuneration, while excluding shareholders' pre-emption rights. In addition, the authorization from 2020 was extended by resolution of the Annual General Meeting on May 11, 2022 to the effect that the Management Board was authorized to issue shares acquired, excluding shareholders' subscription rights, in connection with share-based payment or employee share programs of the Company or its affiliated companies to persons who are or were employed by the Company or one of its affiliated companies or are a member of the management of a company affiliated with the Company. In all other aspects, the authorization from 2020 remained unchanged.

On the basis of the aforementioned authorization of May 7, 2020/May 5, 2021, the Management Board of PUMA SE approved a share buyback program on February 29, 2024. The first tranche provides for the repurchase of treasury shares with a total purchase price of up to € 100 million and begun in March 2024 for the period until May 6, 2025. In accordance with the authorization granted by the Annual General Meeting 2020, the repurchased shares will be cancelled.

By resolution of the Annual General Meeting on 22 May 2024, the aforementioned authorization to acquire and use treasury shares was revoked and the company was again authorized to acquire treasury shares up to ten percent of the share capital until 21 May 2029. In addition, the Supervisory Board was authorized to issue the acquired shares to members of the company's Executive Board, excluding shareholders' subscription rights. Furthermore, the Management Board was authorized to issue the acquired shares to persons who are or were employed by the company or one of its affiliated companies or are members of the management of one of its affiliated companies, excluding shareholders' subscription rights in connection with share-based compensation and employee share ownership programs of the company or its affiliated companies. If the shares are purchased on the stock exchange, the purchase price per share may not exceed 10% or fall short of 20% of the average closing price of the same class of company shares in XETRA (or a comparable successor system) on the last three trading days prior to the obligation to purchase. No use was made of this authorization to purchase treasury shares during the reporting period.

Significant agreements of the Company which are subject to a change of control as a result of a takeover bid and the resulting effects (Section 289a [1][8], 315a [1][8] HGB)

Material financing agreements of PUMA SE with its creditors contain the standard change-of-control clauses. In the case of change of control the creditor is entitled to termination and early calling-in of any outstanding amounts.

For more details, please refer to the relevant disclosures in chapter 17 of the Notes to the Consolidated Financial Statements.

Compensation System of the Management Board

Compensation System of the Supervisory Board

Stiftung Profifussballer helfen Kindern |

Stiftung 2 Grad, Berlin |

Global Sports & Play Initiative e.V. |

Right to Play Deutschland gGmbH |

| Unicef |

SPVGG Oberrad 05 |

Badenstedter SC e.V. |

Evang.-Luth. Kirchengemeinde |

1. FC Herzogenaurach 1916 e.V. |

| Fortuna Mönchengladbach 07/10 e.V. |

PUMA Values

PUMA conducts business in a lawful, fair, respectful, and ethical manner towards our employees, our customers, and our business partners. Not just because we have to, but because we want to, and this is deeply rooted in PUMA's culture.

Compliance Management System

To protect those values, PUMA has established a Compliance Management System (CMS) to systematically prevent, detect, mitigate, and end at an early-stage violations of legal rules. Violations of the law or internal policies will not be tolerated.

PUMA has put in place a CMS which has been based on assessment of risks, development and implementation of proportionate policies and procedures, trainings to educate its employees, the right tone from the top and an effective compliance organization. The CMS is managed by Group Compliance together with our Local Compliance Officers in all subsidiaries worldwide to ensure that all PUMA employees are aware of and comply with PUMA's values.

Code of Ethics

Our PUMA Code of Ethics is an important building block of the CMS and a core element of the PUMA culture. It defines the guidelines and values that shape PUMA's identity and is binding for employees in all PUMA subsidiaries worldwide. PUMA expects all employees to be familiar with these values and to act accordingly. The Code of Ethics is supported by specific groupwide policies.

PUMA’s Electronic Whistleblower System (SpeakUp)

PUMA is committed to operating legally, fairly, respectfully, and ethically throughout all aspects of our business within our own operations and at our business partners.. We have established our whistleblowing platform (SpeakUp) in 2018 and it plays a crucial role in upholding our values. SpeakUp also serves as a way for us to be aware and to be able to prevent or remedy potential risks and violations of the law to PUMA, its employees and its business partners who may be adversely affected.

Any individual or organization can submit a report on SpeakUp globally and may do so in various languages. Therefore, PUMA encourages you to submit a report on SpeakUp if you witness a violation of the law or PUMA policies such as bribery, corruption, money laundering, conflict of interest, anti-trust practices, violations of human rights and environmental protection laws. You may also submit reports on sensitive matters such as sexual harassment and discrimination.

SpeakUp is designed to ensure a confidential and trustworthy channel for reporters to submit a report. SpeakUp is also fully encrypted and secured. Reports may also be made anonymously on SpeakUp.

PUMA will take all reports seriously and investigate thoroughly in a confidential manner. PUMA is also committed to maintaining a safe environment for anyone who submits a report, that is free of harassment, intimidation, discrimination, and any other form of retaliation.

PUMA employees shall be protected from any form of retaliation. For any other persons who are not PUMA employees, PUMA shall work to ensure that no form of retaliation shall be taken against you.

If PUMA confirms a violation or a risk of a violation of the law or PUMA policies, PUMA shall take all appropriate measures to prevent, end or minimize such violations or potential risk of a violation without undue delay. Anyone making a report shall be informed of the closure along with the outcome of the investigation.

For more information on how PUMA processes reports, please refer to Rules for the Complaint Procedure.

Reporting channel for Czech Republic

Any reports concerning PUMA in Czech Republic may be as follows:

Internal Channel

To Mrs. Iva Makalova in person (a meeting to discuss the case shall be scheduled within 14 days of request being made) or by a written notification or voice report made via SpeakUP! platform available at this link: https://puma.integrityline.org/. All reports received shall be acknowledged within 7 days.

PUMA in the Czech Republic accepts all reports.

If you have any questions or face technical issues, you may contact us at any time via e-mail: SpeakUP_CZ@puma.com (do not use it for reporting !) or, during business hours Mon – Fri 9am – 3

pm, at phone no.: 225 996 011 (do not use it for reporting!).

Data Protection

When making a report, you will provide us with personal data. Your personal data, and the personal data of witnesses and subjects of reports, will be collected and stored only to the extent provided by you and necessary for the purpose of conducting the investigation and taking measures to remedy the violation that is reported. The relevant and applicable data protection provisions will always be complied with when handling personal data. Only the personal data that is necessary for carrying out the purposes specified in this paragraph will be processed. Case data will be deleted after five (5) years.

External Channel

You have also a right to submit your report via Ministry of Justice; however, we encourage you to use primarily the internal reporting channels to allow PUMA to quickly clarify and correct any misconduct.

Reporting channel for Poland

Any reports concerning PUMA in Poland may also be made to:

Elzbieta Zagrodnik

Email: Sygnalista.pl@puma.com

Telephone number: +48 601 365 746

For more information on how PUMA processes reports in Poland, please refer to the Whistleblowing Policy.

Data Protection

Personal data are collected and stored only to the extent necessary to fulfill the tasks related to the investigation of a report. PUMA complies with the relevant and applicable data protection regulations when handling personal data.

For more information on the procedures of how PUMA handles reports, please access PUMA's Rules of Procedure.

For any further information or questions about PUMA’s Whistleblowing System, please find the contact information below:

Group Compliance

PUMA SE

PUMA Way 1

91074

Herzogenaurach, Germany

„WE PAY OUR FAIR SHARE“ is the core principle the PUMA-Group is taking into consideration for its global tax strategy. In this regard, PUMA fully commits to act in accordance with all international tax regulations and to fulfill any tax obligations arising from its business activities.

PUMA is not following artificial structures solely to save taxes by those. Of course, taxes play a role in business decisions so to know those and so to do the right thing, however, tax consequences are not the relevant drivers for failing a final sign off on business strategies in this regard.

It is key for PUMA to pay an appropriate portion of its pre-tax profit to tax administrations in the respective countries. Paying tax is accepted as a general business principle of PUMA.