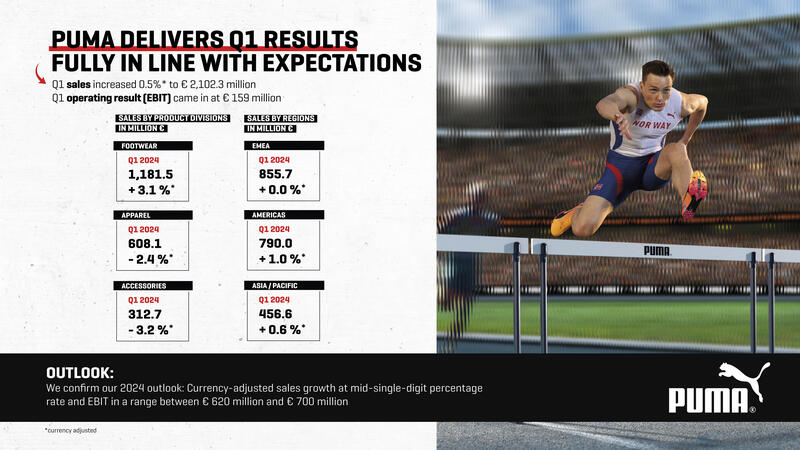

Key developments Q2 2024

- Currency-adjusted (ca) sales increase by 2.1% to € 2,117 million, reflecting a negative currency impact of approximately € 50 million (-0.2% reported)

- Gross profit margin improves by 200 basis points to 46.8% despite major currency headwinds

- Operating expenses (OPEX) increase by 4.3% to € 879 million

- Operating result (EBIT) up by 1.6% to € 117 million despite negative currency effects on sales, gross profit margin and OPEX ratio

- 2024 Sales growth outlook confirmed and EBIT band narrowed within initial range: currency-adjusted sales growth at mid-single-digit percentage rate and EBIT in a range between € 620 million and € 670 million

Arne Freundt, Chief Executive Officer of PUMA SE:

“With our second quarter operating performance, we fully delivered on our outlook for the quarter and are well on track to deliver on our outlook for the full year. I could not be prouder of our team and our strong retail partnerships, which were key to delivering this result in an environment of increased currency headwinds, stressed supply chains and macroeconomic and geopolitical challenges that are weighing on consumer sentiment around the world. With view to our strong orderbook for the second half of the year, wereiterate our sales growth outlook in the MSD range and are narrowing our full-year EBIT outlook range to € 620-670m EBIT in light of these external factors.

With our continued focus on a good sell-through and disciplined sell-in, we were able to improve our wholesale business in all regions, except EEMEA. With our strong order book for the second half of the year, we will see further improvement in our wholesale business in the coming quarters. The robust demand for the PUMA brand continues to be driven by our great product newness and innovation which we launched in the past months. There is more to come in the second half of the year. On the performance side, ULTRA, PUMA’s fastest football boot, Deviate Nitro Elite 3, PUMA’s fastest running shoe, and MB.04, PUMA’s latest version of its bestseller signature shoe with LaMelo Ball will be the key newness and innovations for the second half of 2024. Together with our new design partner Salehe Bembury, we will continue to stir up the basketball market with new disruptive designs in the coming year.

On the Sportstyle side, we are continuing to see strong sell-through with our family footwear retail partners, while we are making good progress in the transition of our Sportstyle Prime offer with Palermo, Suede XL and Easy Rider. We are very encouraged by the first launches of Speedcat in the elevated distribution channels globally and by the great feedback of our retail partners on our product line-up. We are very confident about the future success of the low-profile silhouette and are happy to welcome Rosé, the iconic K-Pop star, as great new ambassador for this emerging trend.

We continue to focus our efforts on increasing the brand desirability for the long-term growth of the PUMA brand. With our first global brand campaign in ten years, we have done the first steps and improved our brand consideration with consumers. Delivering great innovation and newness are further pillars of that strategy. With the Euros, Copa America and now the Olympics, we have the perfect stage to create great brand visibility and credibility in our unmissable “fireglow” shoe colourway and showcase the superiority of our Nitro foam technology which enhances the performance of elite and everyday athletes. We are very proud of the achievements of our athletes and are grateful to celebrate these amazing sporting events and iconic moments together with them.”

Second Quarter 2024

Sales grew by 2.1% (ca) to € 2,117.3 million, while currencies continued to be a headwind, negatively impacting sales in euro terms by approximately € 50 million in Q2 2024 (-0.2% reported).

Sales in the Americas region increased by 9.0% (ca) to € 887.5 million, with both the U.S. and LATAM contributing to the growth and showing a sequential improvement. The Asia/Pacific region recorded sales growth of 1.9% (ca) to € 411.9 million, driven by continued growth in Greater China and sequential improvement in the rest of APAC. In the EMEA region, sales decreased by 4.3% (ca) to € 817.9 million due to a decline in EEMEA from a strong prior year quarter (EEMEA grew +111% ca in Q2 2023), while Europe returned to growth.

PUMA's Wholesale business declined by 3.3% (ca) to € 1,529.6 million, due to the decline in EEMEA. In all other regions, the wholesale business improved quarter-on-quarter, driven by continued good sell-through and improved inventory levels in the trade. Our Direct-to-Consumer (DTC) business grew by 19.5% (ca) to € 587.7 million, supported by continued brand momentum and scaled back promotions. Sales in owned & operated retail stores increased 16.5% (ca) and e-commerce increased 25.6% (ca). This resulted in an increased DTC share of 27.8% (Q2 2023: 24.3%), in line with expectations.

Sales in Footwear were flat (ca) at € 1,097.0 million on the back of a strong prior year quarter (Q2 2023: +18.2% ca) with all Performance categories as well as Sportstyle Core performing very well. Sales in Apparel grew by 9.2% (ca) to € 705.6 million, while sales in Accessories declined by 4.7% (ca) to € 314.8 million.

The gross profit margin improved by 200 basis points to 46.8% (Q2 2023: 44.8%). Significant headwinds from currencies were more than offset by a favourable product and distribution channel mix as well as tailwinds from sourcing and freight.

Operating expenses (OPEX) increased by 4.3% to € 879.3 million (Q2 2023: € 843.4 million). The increase was primarily due to the continued growth of our DTC business and ramp-up costs of warehouse and digital infrastructure projects while all non-demand creating costs remained under strong control. In addition, currency-related headwinds weighed on the OPEX ratio, which increased by 180 basis points to 41.5% (Q2 2023: 39.8%).

The operating result (EBIT) increased by 1.6% to € 117.2 million (Q2 2023: € 115.3 million), despite negative currency effects on sales, gross profit margin and OPEX ratio. Consequently, the EBIT margin improved by 10 basis points to 5.5% (Q2 2023: 5.4%).

The financial result decreased to € -42.6 million (Q2 2023: € -23.0 million) due to higher currency related losses and a lower interest result.

Consequently, net income decreased by 23.8% to € 41.9 million (Q2 2023: € 55.0 million) and earnings per share amounted to € 0.28 (Q2 2023: € 0.37).

The development of the operating result and net income is fully in line with our expectations that the second half of the year, particularly in the fourth quarter, will be stronger than the first half, and that net income will improve in line with the operating result outlook for FY 2024.

First Half Year 2024

Sales increased by 1.3% (ca) to € 4,219.6 million. Currencies were a major headwind, negatively impacting sales in euro terms by approximately € 150 million in H1 2024 (-2.1% reported).

The Americas region led the growth with a sales increase of 5.1% (ca) to € 1,677.5 million, followed by the Asia/Pacific region with a sales increase of 1.2% (ca) to € 868.5 million, while sales in the EMEA region declined by 2.2% (ca) to € 1,673.7 million.

PUMA’s Wholesale business declined by 3.1% (ca) to € 3,137.7 million as a result of disciplined sell-in and focus on good sell-through in preparation for a stronger sell-in in H2 2024. Our Direct-to-Consumer (DTC) business increased by 16.7% (ca) to € 1,081.9 million. Sales in owned & operated retail stores increased 16.0% (ca) and e-commerce increased 18.1% (ca). This resulted in an increased DTC share of 25.6% (H1 2023: 22.8%).

Among product divisions, sales in Footwear increased by 1.6% (ca) to € 2,278.4 million and Apparel grew by 3.5% (ca) to € 1,313.7 million. Accessories decreased by 4.0% (ca) to € 627.5 million.

The gross profit margin increased by 150 basis points to 47.2% (H1 2023: 45.7%). Major headwinds from currencies were more than offset by a favourable product and distribution channel mix as well as tailwinds from sourcing and freight.

Operating expenses (OPEX) increased by 1.9% to € 1,724.6 million (H1 2023: € 1,691.7 million). The continued growth of our DTC business and ramp-up costs for infrastructure projects were the main drivers of this increase. As a result, the OPEX ratio was up 160 basis points to 40.9% (H1 2023: 39.3%), also impacted by currency headwinds.

The operating result (EBIT) decreased by 5.1% to € 276.2 million (H1 2023: € 290.9 million), mainly due to negative currency effects on sales, the gross profit margin and the OPEX ratio, which resulted in an EBIT margin of 6.5% (H1 2023: 6.8%).

The financial result decreased to € -69.4 million (H1 2023: € -30.8 million) due to a lower interest result and higher currency related losses.

Consequently, net income decreased by 25.0% to € 129.3 million (H1 2023: € 172.3 million) and earnings per share amounted to € 0.86 (H1 2023: € 1.15).

The development of the operating result and net income is fully in line with our expectations that the second half of the year, particularly in the fourth quarter, will be stronger than the first half, and that net income will improve in line with the operating result outlook for FY 2024.

Working Capital

The working capital decreased by 2.9% to € 1,643.7 million (30 June 2023: € 1,693.0 million). Inventories decreased by 8.6% to € 1,961.1 million (30 June 2023: € 2,145.9 million). The quarter-on-quarter increase mainly reflects the stronger order book for the second half of the year. The Group's total inventory remains at a healthy level, while quality has further improved. Trade receivables increased by 3.4% to € 1,394.7 million (30 June 2023: € 1,348.4 million). On the liabilities side, trade payables increased by 13.1% to € 1,647.9 million (30 June 2023: € 1,457.3 million).

Cash Flow and Liquidity Situation

The free cash flow was at € -204.4 million in the first half of 2024 (H1 2023: € -341.4 million). As of 30 June 2024, PUMA had cash and cash equivalents of € 271.8 million (30 June 2023: € 307.9 million). In addition, the PUMA Group had available credit lines totalling € 1,411.7 million as of 30 June 2024 (30 June 2023: € 1,592.5 million). Unutilized credit lines amounted to € 595.4 million as of 30 June 2024 (30 June 2023: € 846.0 million).

Share Buyback

The share buyback programme announced by PUMA SE on 29 February 2024 began on 07 March 2024. By 30 June 2024, a total of 700,413 shares had been bought back for around € 31.3 million.

Outlook 2024

The first half of the year was characterized by a volatile environment with persistent currency headwinds, stressed supply chains and muted consumer sentiment globally. In this challenging environment, PUMA continued to make progress on its strategic initiatives of brand elevation, product excellence and distribution quality with special focus on the U.S. and China, and focused on strong sell-through and the best possible service to its retail partners, brand ambassadors and consumers.

Based on the results of the first half year and supported by building brand momentum as well as by our strong orderbook for the second half of the year, PUMA reiterates its outlook for the financial year 2024 of mid-single-digit currency-adjusted sales growth. Taking into account the external factors of higher freight costs, changing duties and continued muted consumer sentiment, especially in China, we narrow our outlook for the operating result (EBIT) to a range of € 620 million to € 670 million (2023: € 621.6 million; previous outlook: € 620 – 700 million). We expect net income (2023: € 304.9 million) to change in 2024 in line with the operating result.

As in previous years, PUMA will continue to focus on managing short-term challenges without compromising the brand's medium- and long-term momentum. Our sales growth and market share gains will take priority over short-term profitability. The very positive feedback from our retail partners and consumers on our 2024/2025 product line-up and go-to-market strategies gives us confidence for the medium and long term success and continued growth of PUMA.

Q2 Brand & Strategy Update

Making Progress in Brand Elevation

Launch of PUMA’s biggest Brand Campaign ever in April 2024

- Brand Campaign “See The Game Like We Do” demonstrates PUMA’s superpower Speed and establishes strong emotional connection between the consumer and PUMA brand mantra FOREVER.FASTER.

- PUMA dedicates brand campaign spin-offs to UEFA Euro 2024 and 2024 Copa America, featuring best-in-class Football Players, like Neymar Jr., Xavi Simons, Kai Havertz and Cody Gakpo

- Brand campaign created best ever PUMA brand visibility and improved brand consideration with consumers

World-class performance by PUMA’s sponsored teams and players underscores strong position in Football

- Great visibility at Euro 2024 with approx. 100 players wearing “fireglow” colourways of FUTURE, ULTRA and KING

- Manchester City wins Premier League fourth time in a row

- Borussia Dortmund reaches final of Champions League 23/24

- PUMA to be strongest brand in Bundesliga season 24/25 with sponsoring 6 teams

- AC Milan and French National Team star Theo Hernández joins PUMA

PUMA Athletes set three new world records in Track and Field

- Seven gold medals for PUMA athletes at European Athletics Championships in Rome

- High jumper Yaroslava Mahuchikh breaks 37-year-old world record, clearing 2.10m

- Armand “Mondo” Duplantis sets new pole vault world record of 6.25m

- Devynne Charlton breaks 60m hurdles world record in 7.65s

- In PUMA NITROTM shoes, runners take podiums at marathon majors for first time in decades

- PUMA to provide kits for 17 track & field federations at the Olympic Games and 7 federations at the Paralympic Games in Paris

- PUMA joins forces with the Athletic Federation of India as Official Kit Partner

Further Improvement of Brand Visibility and Recognition

- Renowned K-Pop artist Rosé joins PUMA as global brand ambassador to support classic franchises, including the Palermo and Speedcat

- Eye-catching “fireglow” colours of the football boots and track and field spikes worn by more than 450 of our players and athletes create great visibility in Paris

Rebounding in China

Building up performance credibility with Chinese consumers

- PUMA sponsors Xiamen Diamond League for second year in a row to strengthen position as an international sports brand

- PUMA becomes Top 10 Brand at Wuxi Marathon, one of the world’s largest

- China tour of PUMA ambassador and NBA-Star Scoot Henderson captures basketball excitement in the country

Driving Brand Heat

- Announcement of PUMA x Rosé collaboration generates the biggest social media stir of PUMA in China in the past years and improves brand consideration

- PUMA captures hype around F1 GP in China with visit by Chinese driver Zhou Guanyu to pop-up space and livestreamed catwalk show on Tmall and Tencent with millions of views

- Singer and songwriter Henry Lau joins PUMA Family and stars in successful Forever.Dance. campaign

Business Highlights in a challenging Environment

- PUMA’s growing brand momentum in China confirmed by strong sales growth at online shopping festival 6/18, where sales exceed industry average on Tmall and JD

- Locally designed apparel collections with local fitting and design details, featured by Henry Lau, resonates well with consumers

- Palermo and Speedcat become bestselling franchises with immediate sell-out of initial Speedcat launch

- New footwear-focused store concept “Sneaker Box” opens in Shanghai, featuring elevated store design and consumer experience in line with brand elevation strategy

- PUMA continues to roll out “Field of Play” store format designed and developed in China

Winning in the USA

Building performance credibility with US customer

- PUMA enjoys great visibility as official partner of CONMEBOL Copa America 2024

- Neymar Jr. and Christian Pulisic host PUMA events to create buzz for Copa America

- Fiona O’Keeffe and Dakotah Lindwurm secure first and third place at US Olympic Marathon Trials in NITROTM running technology

- All-Pro NITROTM becomes shoe of leading amateur basketball circuit NXTPro Hoops

- Exclusive Ferrari collection at Miami GP sells out immediately

Launching US-first product propositions

- Rihanna continues to drive brand heat with new Back-To-School editions of Creeper and Avanti

- A$AP Rocky presents Inhale sneaker, a sell-out success

- PUMA announces collaboration with trailblazing footwear designer Salehe Bembury to reimagine signature shoe category in basketball

Investing for future growth

- Tara McRae joins PUMA North America as Senior Vice President Marketing & Brand Strategy from Clark’s

- PUMA announces to open its LA Studio in Q1/25, a new product and design hub in Los Angeles that will design products specifically for the US market

- PUMA opens new distribution centre in Arizona to support future growth in US from an operational point of view

Ongoing Momentum in Performance

Continued market share gains in Football

- Next-gen football boot FUTURE 7, featured by Neymar Jr. and Kai Havertz, gives players new level of freedom of movement

- ULTRA football shoe launched with new high-performance outsole design, generating strong sell-through

- Gripping performances of PUMA-Teams Austria and Switzerland lead to sell-out success of jerseys

- Fan shirt campaign with German comparison platform Check24 generates outstanding visibility during summer of sports

Driving further Momentum in Running & Training

- Third iteration of award-winning running shoe Deviate NITROTM is engineered with even more NITRO™ foam to deliver supreme cushioning and responsiveness

- Recognition by Running Experts: Ultimate race-day running shoe Fast-R2 awarded Spanish CORREDOR Award for the best new shoe 2024

- Announcement of global partnership with HYROX - the world series of fitness racing – which continues to build up great hype momentum as a fitness trend

Introducing innovative product newness in Basketball and Golf

- Following success of MB signature shoes, LaMelo Ball presents LaFrancé, his first lifestyle shoe

- Launch of third signature performance shoe for WNBA Player Breanna Stewart - the Stewie 3 - incorporates PUMA’s latest performance technology

- Designed by aerospace engineers, Cobra’s new DARKSPEED driver series are built for extraordinary speed and distance

Building Up Traction with Sportstyle Newness

Maximise current trends

- PUMA’s terrace model Palermo and skate model Suede XL continue to resonate well with target group

- With Easy Rider, PUMA brings back retro running style with sought-after T-toe style for a new generation

- Launch of communication platform Rewrite the Classics to highlight and raise awareness for PUMA’s classics franchises

Creating next trends

- Successful launches of Mostro and Speedcat confirm emerging low-profile trend

- PUMA demonstrates fashion appeal of low-profile styles during Paris Fashion Week in runway shows with A$AP Rocky, KidSuper and other influential designers

- British rapper Skepta joins PUMA to create sell-out Skope Forever sneaker and football inspired Más Tiempo collection

- PUMA and best-selling anime series One Piece present successful collection

Strengthening the Foundation

- Harsh Saini and Roland Krüger join PUMA’s Supervisory Board

- TIME magazine ranks PUMA as only company in its industry among “World’s Most Sustainable Companies”