Cash Flow and Liquidity Situation

The free cash flow increased significantly by 107.9% to € 369.0 million in 2023 (FY 2022:

€ 177.5 million). On 31 December 2023, PUMA had cash and cash equivalents of € 552.9 million, an increase of 19.4% compared to 2022 (31 December 2022: € 463.1 million). In addition, the PUMA Group had credit lines totalling € 1,552.8 million as of 31 December 2023 (31 December 2022: € 1,271.0 million). Unutilised credit lines were at

€ 986.1 million on the balance sheet date compared to € 943.7 million at the end of 2022.

Proposal of a Dividend of € 0.82 per share

The positive net income enables the Management Board and the Supervisory Board of PUMA SE to propose to the Annual General Meeting on 22 May 2024 the distribution of a dividend of € 0.82 per share for the financial year 2023. This corresponds to a payout ratio of 40.3% of consolidated net income. The higher payout ratio is a result of the strong improvement in free cash flow and reflects the underlying positive operating business development. The payment of the dividend is scheduled to take place in the days following the Annual General Meeting at which the dividend is approved. In the previous year, a dividend of € 0.82 per share was paid out (payout ratio for the previous year: 34.7%).

Outlook 2024

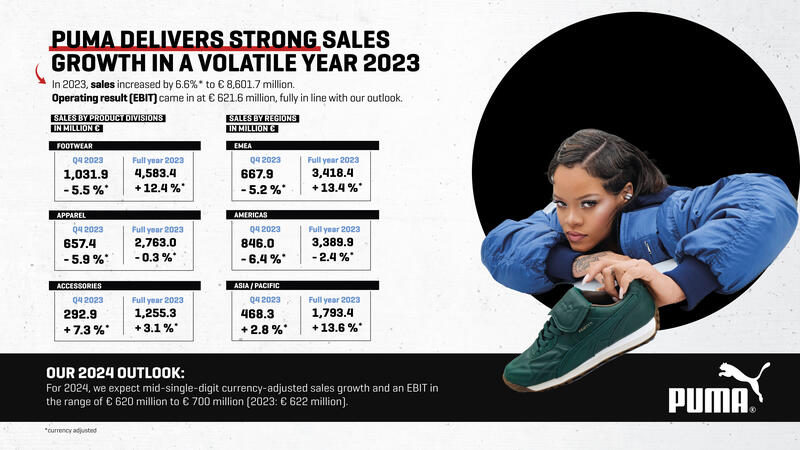

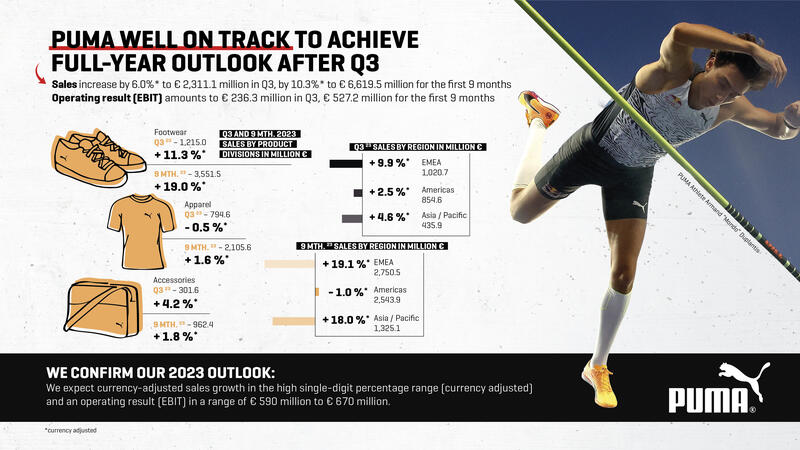

We expect geopolitical and macroeconomic headwinds as well as currency volatility to persist in 2024. These conditions already led to muted consumer sentiment and volatile demand in 2023 and we expect these effects to continue in 2024, particularly in the first half of the year.

In this continued challenging environment, we are fully focused on executing our strategic priorities: elevating the brand, increasing product excellence and improving our distribution quality - especially in the key markets U.S. and China. For us, 2024 is not only the year of sport with major events such as the Olympic Games, UEFA Euro 2024 and the Copa America providing the perfect platform to showcase our strong product innovation and credibility as a performance brand. It is also the year in which PUMA will invest into its first global brand campaign in 10 years to sharpen its positioning as the fastest sports brand in the world.

Supported by the continued brand momentum and despite ongoing global geopolitical and macroeconomic challenges, PUMA expects to achieve mid-single-digit currency-adjusted sales growth and an operating result (EBIT) in the range of € 620 million to € 700 million for the financial year 2024 (2023: € 621.6 million). The outlook assumes that the future devaluation of the Argentine peso will be fully compensated by corresponding price increases in Argentina. We expect net income (2023: € 304.9 million) to change in 2024 in line with the operating result.

As in previous years, PUMA will continue to focus on managing short-term challenges without compromising the brand's medium- and long-term momentum. Our sales growth and market share gains will take priority over short-term profitability. The exciting product range for 2024 and the very good feedback from retail partners as well as consumers give us confidence for the medium- and long-term success and continued growth of PUMA.

Brand & Strategy Update

2023 Highlights

Foundation for PUMA’s brand elevation established

- Reorganization of global Brand & Marketing organization by relocating Brand Marketing from Boston to the company headquarters in Herzogenaurach

- Establishment of new Marketing and Brand leadership team

- Launch of PUMA’s biggest Brand Campaign ever in April 2024

Great Performance innovation underpins business growth

- Strong product innovations of PUMA’s Football boots FUTURE, ULTRA and KING deliver significant market share gains globally

- Award-winning NITRO foam technology makes PUMA the fastest growing performance running brand in Europe

- All-Pro NITRO debuts as one of the best basketball shoes in NBA according to “Weartesters Best Basketball Shoes 2024”, worn by NBA rookie Scoot Henderson and FIBA World Cup Winner Dennis Schröder

PUMA makes athletes to perform at their best

- PUMA’s Running Innovations help win 22 medals at the World Athletics Championships in Budapest, twice as many compared to 2022

- PUMA Deviate NITRO Elite leads Fiona O’Keeffe to her personal best setting the fastest debut pace ever by a woman at the U.S. Olympic Marathon Trials

- PUMA team Manchester City wins five major trophies: UEFA Champions League, Premier League, FA CUP, UEFA Super Cup and FIFA Cup

- PUMA Football National Team Ivory coast wins Africa Cup 2024

- In Basketball, Breanna Stewart became the most valuable WNBA player for the second time and Dennis Schröder was voted MVP of the World Championships

New Partnerships drive credibility and commercial success

- PUMA’s strong position in Football attracted world-class players to join the PUMA family such as Kai Havertz, Jack Grealish, Xavi Simons, Alex Greenwood, Cody Gakpo and Daniel Carvajal

- PUMA’s credibility as record-winning Track & Field brand helps attract Olympic 100m champion Marcell Jacobs and NCAA 100m champion Julien Alfred

- A$AP Rocky joins PUMA as Creative Director for Formula 1 to help create exciting collections for F1 fans

- Rihanna returns to the PUMA Brand to relaunch FENTY x PUMA

Trendsetting Newness in Fashion and Sportstyle

- Rihanna’s Avanti and Creeper Phatty create great buzz

- PUMA manifests low-profile trend as sneaker icon Mostro returns at New York Fashion Week and iconic PUMA Speedcat relaunches successfully in South Korea

- PUMA’s terrace trend styles Palermo and Superteam are continuing to accelerate traction with consumers

- Skate Trend: PUMA introduces Suede XL as new trend sneaker

- A$AP Rocky presents first Formula 1 capsule collection at Las Vegas Grand Prix

Making huge strides on Sustainability Journey

- Two out of PUMA’s 10FOR25 Targets already achieved in 2023

- SBTI 2030 greenhouse gas emission reduction targets already achieved in 2023

- 8 out of 10 PUMA products made with recycled or certified materials in 2023

- PUMA to make all football jerseys from recycled textile waste with RE:FIBRE

- RE:SUEDE circularity project turns experimental sneakers into compost

2023 Detailed Brand and Strategy Update

In 2023, we sharpened our strategy to pursue long-term, sustainable growth across all geographies and product categories. To achieve our long-term vision of consistently outperforming the market, our highest priorities remain to drive brand elevation, increaseproduct excellence and improve our distribution quality.

Given the relevance of these markets, special emphasis has been placed on laying the foundation for sustainable long-term growth in the USA and China.

Foundation for PUMA’s brand elevation established

In July 2023, we relocated our brand management and marketing operations from Boston to Herzogenaurach and made the organizational changes that are necessary to implement our core strategy of elevating the PUMA brand. As part of this relocation, we also introduced a new global leadership team. Richard Teyssier, who before joining PUMA in 2010 held senior marketing and brand management positions for major FMCG companies, became Vice President Brand & Marketing. In early 2024, Richard was joined by Julie Legrand as Senior Director Global Brand Strategy, who previously worked as H&M’s Global Brand Director. Julie will define and execute our strategy to drive higher visibility and strengthen the PUMA brand and its perception around the world.

We also established a Consumer Insights Team to gain a deeper understanding of our consumers across the entire organization to inform and align our marketing strategies and product engine. To be closer to our most valuable entertainment ambassadors, we complemented our entertainment marketing hubs in Los Angeles and London with an additional hub in Seoul.

The first major outcome of our brand elevation strategy will be PUMA’s biggest brand campaign ever. Set to launch in April 2024, we are confident that this campaign will create a long-term positive effect for the PUMA brand. The campaign, which will feature some of our best-known brand ambassadors, will create an emotional connection with our consumers around the world.

USA – Strengthening the Organisation and anchoring PUMA in Sports

We used 2023 to reset our U.S. business by cleaning our inventory, reducing dependency from offprice channels and strengthening our organization. In a challenging U.S. market, our U.S. business was over-proportionally challenged as we were not strong enough positioned as a sports brand and overdependent on off-price business.

Basketball is a crucial part of our strategy to win in the important U.S. market, elevate the brand and clearly reposition PUMA as a sports brand. Our great line up of basketball ambassadors helped us execute this plan by creating exciting products with us and performing strongly on court. This led to PUMA becoming a TOP 3 signature and performance brand in the US. We are also gaining a perception impact of the halo effect from Basketball with key teen male consumers, where we have moved to #6 favorite brand ranked in Fall 2023 after being below the top 10 in Fall 2021 according to a study by Piper Sandler in 2023.

In 2023, we strengthened our local organization and appointed Andrew Rudolph as Senior Vice President Sales and Alexa Andersen as Senior Vice President Merchandising. With our two new leaders we will pursue a clearer focus to drive the growth in the desirable Wholesale channels and an elevated merchandising strategy in the USA.

China - Making PUMA one of the most sought-after international sports brands

In 2023, we implemented a new China-for-China strategy to increase relevancy and brand heat for the local consumer and rebuilt the entire China organization.

In June, we appointed Shirley Li as the new General Manager. Shirley is a native Chinese and has more than 20 years of industry experience with a deep understanding of the Chinese market and consumer. In addition, we hired a new Commercial Director, Marketing Director, Digital Retail Director and Merchandise Director – all with a profound knowledge of the local market and consumer.

We continued to increase Sports Marketing to position PUMA as a credible sports brand. We signed relevant athletes such as national female Basketball player ZhangRu and sponsored sports events such as Xiamen Diamond League 2023. We also started to collaborate with famous celebrities such as Cici Song and more of such signings will come in 2024.

With view to the advanced digital costumer journeys in China, we invested in digital marketing and social ecommerce and saw a strong increase of brand heat on Tiktok both by search volume and users in 2023. In addition, we partnered with Tencent to enable us to build a digital member hub, that delivers comprehensive consumer data and insights, tailor made content and product offering as well as seamless omni channel operation.

We further enhanced our local-for-local design and production capabilities to be relevant for local consumers. In 2024, around 40% of the products will be designed locally, while around 80% will be produced in China. With our new store format “Field of Play”, we are able to create an authentic brand experience and introduced a compelling new store environment to the Chinese consumers.

Great Performance innovation underpins business growth

We have achieved significant growth through product newness and technology & design innovations, which has led to significant market share gains, particularly in sports categories such as Football, Running and Basketball.

In Football, we successfully established our Football boot franchises FUTURE, ULTRA and KING, which helped to gain significant market shares in football in all markets globally. All three franchises continue to be the strongest growing football styles in Europe. With this strong performance, PUMA’s market share in Football has quadrupled in the last 5 years.

The latest release FUTURE 7 adapts to the shape of your foot, so the player can move without constraints for 90 minutes and beyond. The boot’s FUZIONFIT360 upper, a combination of different densities and mesh patterns, provides adaptable support, empowering players to experience a new level of 360-degree freedom of movement.

We made big headlines by bidding farewell to Kangaroo leather and completely redesigned our legendary PUMA KING football boot with our new, animal-free material K-BETTER, which provides even better benefits to the football players. We were the first company in the industry to completely stop using kangaroo leather in 2023.

To underscore our commitment to women in sports, we were the only sports brand to offer all our football boots in women’s specific fits at the Women’s World Cup. The fact that more than 90% of our world-class players during the tournament in Australia and New Zealand chose our women’s specific boots highlights the real demand for these innovative football boots.

Another key highlight of PUMA’s product newness and innovation breakthrough is our award-winning running technology NITRO, which is at the core of our efforts to become a sought-after road running brand and helps the world’s fastest athletes perform on top of their game. In the third year since the introduction of NITRO, PUMA became the fastest growing performance running brand in Europe. We established a line-up of running products with a clear set of benefits for the consumer: Velocity for everyday running, Deviate for speed and ForeverRun for guidance and cushioning.

NITRO foam was also introduced in our latest basketball shoe, the All-Pro NITRO, worn by NBA rookie and the third NBA Draft Pick Scoot Henderson as well as the MVP of the FIBA Basketball World Cup Dennis Schröder. Henderson also became the youngest player ever to receive his own signature shoe, the Scoot Zeros. Following the success of his first signature products, PUMA’s basketball ambassador LaMelo Ball followed up with the MB.03 signature shoe, which was introduced in several colours and styles throughout the year. Breanna Stewart, our WNBA ambassador introduced several versions of her signature shoe Stewie 2.

PUMA makes athletes perform at their best

Testament to the power of PUMA’s Running Innovation were 22 medals, including six gold medals, at the World Athletics Championships in Budapest, twice as many compared to 2022 in Eugene. PUMA athletes also won 17 medals at the European Indoor Championships in Istanbul and 13 medals at the World Para Athletics Championships in Paris. PUMA’s Armand “Mondo” Duplantis was named “Male Athlete of the Year”, after he once again improved the pole vault world record which now stands at 6.23 meters.

The PUMA Deviate NITRO Elite helped U.S. Athletes Fiona O'Keeffe and Dakotah Lindwurm qualify for the Olympic Marathons with O'Keeffe setting the fastest debut pace ever by a U.S. woman. PUMA also propelled athlete Devynne Charlton to break 16-year-old 60m hurdles world record.

In Football, we celebrated a historic moment when PUMA team Manchester City won five major trophies: the UEFA Champions League, the Premier League, the FA CUP, the UEFA Super Cup as well as the FIFA Cup.

On the national team side, we celebrated the victory of PUMA Football National Team Ivory Coast at the Africa Cup 2024.

In Basketball, Breanna Stewart became the "Most valuable WNBA Player” for the second time and Dennis Schröder was voted MVP of the tournament at the Basketball World Championships in Southeast Asia, which his team Germany won.

In Golf, PUMA ambassador Rickie Fowler captured his sixth PGA Tour victory at the Rocket Mortgage Classic in Detroit, while Patricia Isabel Schmidt secured her maiden European Tour win at the Belgian Ladies Open.

New Partnerships drive credibility and commercial success

PUMA’s strong position in Football Innovation attracted world-class players to join the PUMA family: Arsenal and Germany midfielder Kai Havertz, Manchester City and England playmaker Jack Grealish, RB Leipzig and Netherlands midfielder Xavi Simons, FC Liverpool and Netherlands striker Cody Gakpo, Real Madrid and Spanish National Team right-back Daniel Carvajal and Manchester City and English national team defender Alex Greenwood.

PUMA also became the long-term partner of the CAF, the African Football Confederation.

and CONMEBOL, the South American Football Confederation.

PUMA’s credibility as a record-winning Track & Field brand helped to sign world-class athletes such as Olympic 100m champion Marcell Jacobs and NCAA 100m champion Julien Alfred. The signing of European 5,000m Champion Konstanze Klosterhalfen, marathon legend Edna Kiplagat and European marathon Champion Aleksandra Lisowska underpinned the credibility of PUMA’s NITRO foam technology.

We captured the increasing popularity of Formula 1, both in the U.S. and globally and became the official licensing partner and exclusive trackside retailer of Formula 1. To help us create the exciting collections for the growing number of F1 fans around the world, we signed A$AP Rocky as the Creative Director for F1. We believe that as one of the biggest cultural influencers, A$AP will provide a new perspective on the world of car culture. A first glimpse of what this will look like was seen during the Las Vegas Grand Prix, where he unveiled a first capsule collection.

PUMA also used the setting of the much-anticipated race in Las Vegas for several events that highlighted our commitment to motorsport, including a spectacular display on the Las Vegas Sphere, a Car Club Event and PUMA’s own hospitality suite at the Paddock Club.

To maintain our strong position in Formula 1, we also extended our long-term partnership with Scuderia Ferrari and signed a new contract with Williams Racing.

The return of global superstar Rihanna to PUMA, was one of our most important announcements of 2023 and fully in line with our strategy to work with the world’s most influential ambassadors.

Trendsetting Newness in Fashion and Sportstyle

In 2023, PUMA continued to pioneer the Sportleisure industry and set new trends.

First and foremost, PUMA invested in the incubation of the “Low Profile” sneaker trend, which is characterized by a flatter outsole, moving the whole silhouette closer to the ground. The Mostro and Speedcat are two iconic PUMA franchises with a distinct point of difference that are setting the path for this trend. Highlights of 2023 were the appearance of the Mostro sneaker during the Paris fashion week in collaboration with the Berlin based fashion label “Ottolinger”. The New York Fashion Week earlier this month saw the Mostro-themed Catwalk “Welcome to the amazing Mostro show” which caused great media attention and hype around the Mostro Franchise. Meanwhile, PUMA continues to incubate the Speedcat Franchise through seeding activities. The first sales results from South Korea, where the model launched in January, are great and numerous credible Fashion sources like “GQ Germany” already predict the model to be the new hype sneaker for 2024.

Besides the incubation of new trends, PUMA also launched great newness supporting the ongoing skate trend with models like the PUMA-180, the Suede XL as a skate-inspired iteration of PUMA’s most iconic model, the Suede OG as well as Rihanna’s plateau style Creeper Phatty. To bring additional hype and energy to the skate trend, PUMA collaborated with authentic brands like “Rip n Dip”, “Pleasures” and “Butter Goods” that have credibility in this space and resonate strongly with the streetwear driven consumer.

The football inspired terrace trend is also currently shaping the market. We were on time to launch two new strong franchises, the “Palermo” and the “Super Team” that are commercially very relevant. Collaborations with the Palermo Football Club for a special Jersey further amplified the football authenticity of this story. Global ambassador Dua Lipa headlined the Palermo campaign and wears the model in her latest music video “Houdini” which has already more than 75M views in YouTube. Another successful terrace style was Rihanna’s first product in 2023, the Avanti.

Making huge strides on Sustainability Journey

In Sustainability, we made significant progress with our FOREVER. BETTER. sustainability strategy and our 10FOR25 targets.

We were able to reach two of our 10FOR25 targets ahead of schedule. For our “Plastics and the Oceans” target, we no longer used plastic carrier bags in PUMA’s owned and operated stores, we supported scientific research on microfibres and researched biodegradable plastic options with our RE:SUEDE circularity experiment.

With RE:SUEDE, we showed that we can turn an experimental version of our classic Suede sneaker into compost under certain tailor-made industrial conditions. A commercial version of the RE:SUEDE will launch with our partner Zalando on Earth Day in April 2024.

We also reached our Human Rights target ahead of 2025 by training more than 220,000 factory workers on women’s empowerment and completely mapping subcontractors and our Tier 2 suppliers for human rights risks.

We successfully reduced our greenhouse gas emissions and introduced a new, more ambitious science-based target for 2030. Despite strong sales growth, we reached our previous science-based target, which was introduced in 2019 and based on a “well below 2-degrees” scenario, seven years early.

By using renewable energy, including renewable energy certificates, in our own warehouses, stores and offices, and by significantly investing in electric vehicles for our car fleet, we were able to reduce our own greenhouse gas emissions by 85% compared to our 2017 baseline.

PUMA was able to reduce overall greenhouse gas emissions by 24% in 2023 compared to 2022, as our core suppliers doubled their use of renewable energy in 2023 compared to the previous year and our logistics partner Maersk introduced low carbon shipment tariffs on our most important sea freight routes.

PUMA’s new climate goals, which were approved by the Science Based Targets Initiative, aim to reduce our emissions by what scientists say is necessary to keep global warming below 1.5 degrees. By 2030, we want to reduce our own greenhouse gas emissions by 90% and those coming from our supply chain and logistics by 33%, compared to 2017.

In 2023, 8 out of 10 PUMA products were made with a significant part of recycled or certified materials. We also scaled up the use of recycled materials. Almost 65% of polyester in our apparel and accessories came from recycled sources as did 8.6% of our cotton.

Starting 2024, all of PUMA’s replica football jerseys are now made from textile waste using PUMA’s RE:FIBRE recycling technology. The RE:FIBRE process focuses on textile waste as the primary source of material, which is broken down on a chemical level to create new textiles. The recycled material is just as good as new and can be used for recycling again and again without losing quality – making RE:FIBRE a promising and more sustainable long-term solution for recycling polyester textile waste.

Transparency and engaging with Gen Z consumers in sustainability projects is a crucial part of our sustainability communication. In 2023, we launched our Voices of a RE:GENERATION initiative, which gives four Gen-Z environmental activists access to our senior management to give their feedback on PUMA’s sustainability strategy. Three of our voices visited PUMA’s supplier factories in Bangladesh, Vietnam and Turkey to get firsthand insights into our supply chain and some of the realities and challenges of sustainability at scale. The voices also help us to authentically communicate our sustainability initiatives to our Gen-Z audience.