Second Quarter 2021

Sales increased by 95.8% (ca) to € 1,589.1 million (+91.2% reported). All regions and product divisions contributed with at least double-digit sales increases (ca). Americas reported the strongest growth of 181.8% (ca), driven by strong demand for the PUMA brand in the North American market, followed by EMEA, which improved 85.4% (ca) and Asia/Pacific being up 29.6% (ca). Footwear was the growth driver (+114.0% ca), based on continued strong performance of our Running and Training as well as Sportstyle categories. Also, Apparel (+85.5% ca) and Accessories (+72.2% ca) showed strong growth in the second quarter of 2021. Compared to the second quarter of 2019, sales were up 36.3% (ca) with all regions and product divisions delivering double-digit increases.

PUMA’s Wholesale business grew by 114.2% (ca) to € 1,200.0 million. The Direct to Consumer business (DTC) increased by 54.7% (ca) to € 389.1 million with growth in owned & operated retail stores (+107.0% ca) and e-commerce (+8.5% ca). After stores gradually reopened in the second quarter, demand shifted partially from the e-commerce channel to retail stores, while the overall underlying demand for the PUMA brand was strong.

The gross profit margin in the second quarter improved by 360 basis points to 47.5% (Q2 2020: 43.9% / Q2 2019: 49.3%). The improvement in gross profit margin was driven by better sell-through and less promotional activity, while inefficiencies in the supply chain including inbound freight had a negative impact.

Operating expenses (OPEX) increased by 34.5% to € 650.4 million (Q2 2020: € 483.5 million / Q2 2019: € 531.6 million) due to higher marketing expenses as well as sales-related distribution and warehousing costs. As a result of COVID-19, we continued to face operating inefficiencies in our business. The OPEX ratio in percent of total sales decreased from 58.2% in the second quarter of 2020 to 40.9% in the second quarter of 2021 (Q2 2019: 43.3%).

The operating result (EBIT) in the second quarter increased to € 108.9 million (Q2 2020: € -114.8 million / Q2 2019: € 80.3 million) due to strong sales growth, higher gross profit margin and continued OPEX control. This resulted in an improved EBIT margin of 6.9% in the second quarter of 2021 (Q2 2020: -13.8% / Q2 2019: 6.5%).

Net earnings increased from € -95.6 million to € 48.7 million and earnings per share improved from € -0.64 in the second quarter of 2020 to € 0.33 in the second quarter of 2021.

First Half-Year 2021

Sales increased by 53.6% (ca) to € 3,137.9 million (+47.3% reported). The strong sales development was driven by double-digit growth rates in all regions and product divisions. Compared to the first half of 2019, PUMA’s sales grew 30.0% (ca).

The Wholesale business was up 57.3% (ca) to € 2,402.0 million while the Direct to Consumer business (DTC) increased by 42.7% (ca) to € 735.9 million with growth in owned & operated retails stores (+49.2% ca) as well as e-commerce (+33.5% ca).

The gross profit margin in the first half of 2021 improved by 180 basis points to 48.0% (H1 2020: 46.2% / H1 2019: 49.2%). The improvement in gross profit margin was driven by better sell-through, less promotional activity and a low base in 2020 due to the negative impact of the COVID-19 pandemic.

Operating expenses (OPEX) increased by 20.7% to € 1,251.5 million (H1 2020: € 1,036.8 million / H1 2019: € 1,042.3 million) due to higher marketing expenses, sales-related distribution and warehousing costs as well as operating inefficiencies due to COVID-19. The respective OPEX ratio in percent of total sales decreased from 48.7% in the first half of 2020 to 39.9% in the first half of 2021 (H1 2019: 40.9%).

The operating result (EBIT) in the first half of 2021 increased significantly to € 263.2 million (H1 2020: € -43.6 million / H1 2019: € 222.8 million) due to strong sales growth, higher gross profit margin and continued OPEX control. This resulted in an improved EBIT margin of 8.4% in the first half of 2021 (H1 2020: -2.0% / H1 2019: 8.8%).

Net earnings increased from € -59.4 million to € 157.8 million and earnings per share were up from € -0.40 in the first half of 2020 to € 1.06 in the first half of 2021.

Working Capital

The working capital increased by 6.1% to € 691.9 million (June 30, 2020: 652.1 million). Inventories were up by 7.7% at € 1,388.7 million despite the supply chain constraints due to container shortages and port congestion. As a result of the strong sales development in the second quarter, trade receivables rose by 62.6% to € 931.1 million and on the liabilities side, trade payables were up by 39.9% to € 1,270.6 million.

Cash Flow and Liquidity Situation

The free cash flow in the first half of 2021 improved significantly to € 24.6 million (H1 2020: € -206.0 million). This development was a result of the strong increase of earnings before taxes (EBT), while cash outflows for working capital and capital expenditures increased. PUMA’s cash and cash equivalents as of June 30, 2021 amounted to € 755.2 million (June 30, 2020: € 437.0 million). In addition, at the end of the second quarter, PUMA had unutilized credit facilities amounting to a total of € 934 million (June 30, 2020: € 1,263 million).

Outlook 2021

2021 started with an all-time high of COVID-19 cases globally and continued restrictions for our operations in numerous markets as well as supply chain constraints due to container shortages and port congestion. In addition to the implications from the COVID-19 pandemic, political tensions in some of our key markets also had a significant impact on our business. Despite the uncertainty, PUMA has maneuvered well throughout the first half of the year based on continued brand momentum, successful product launches with high sell-through and a strong focus on flexibility in our operations.

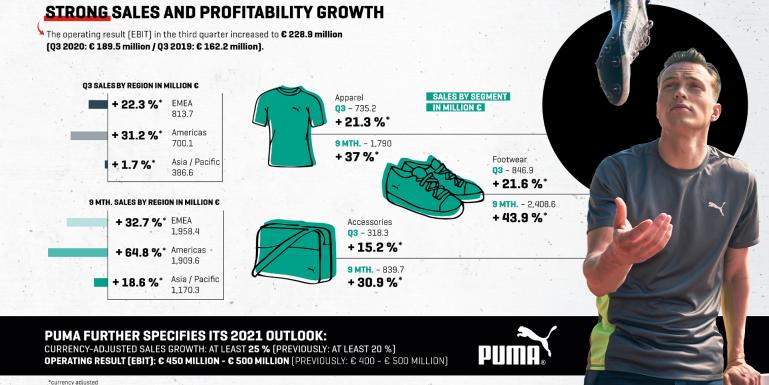

In light of the sales and profitability growth, especially in the second quarter, PUMA now expects the currency-adjusted sales to increase at least 20% (previous outlook: mid-teens currency-adjusted sales growth) in the financial year 2021. The outlook for the operating result (EBIT) has been further specified and is now anticipated to come in between € 400 million and € 500 million (previous outlook: significant improvement). In line with the previous outlook, we do not provide a detailed outlook on our gross profit margin and OPEX-ratio. Our net earnings are still expected to improve significantly in 2021.

As COVID-19 cases are rapidly growing in key sourcing countries in Asia, securing the supply of our products remains a high priority for us. The recent lockdown measures taken by the government in Vietnam result in suspended production at some of our suppliers in South Vietnam. As the duration, intensity and a potential extension of the lockdown measures to other countries remains uncertain, the achievement of our outlook will be subject to continued manufacturing without further major interruptions due to the COVID-19 pandemic.

PUMA will continue to mitigate the negative short-term implications of the COVID-19 pandemic by building on its brand momentum and the strong relationships which it gained from being a reliable partner, especially throughout 2020. Our strong and profitable growth in the first half of 2021, a strong product line-up for the rest of the year and very good feedback from retail partners and consumers make us confident for the mid-term success and growth of PUMA.

Brand and Strategy Update

Following a year marked by the COVID-19 pandemic, PUMA started 2021 with a strong orderbook across all regions. Despite first positive signs regarding the development of the pandemic, especially in the second quarter, we had to manage the implications of lockdowns and restrictions in different markets and sourcing countries. Wherever needed, we focused on working together with all of our partners to manage the short-term challenges, such as store and factory closures, without hindering our mid-term momentum.

The health and safety of our partners, customers and employees remained a top priority in the first half. Where it was possible, we offered COVID-19 vaccines to our employees. At our headquarters in Herzogenaurach, Germany, PUMA vaccinated more than 1,000 employees and 90 percent of our staff was fully vaccinated by mid-July. In India, which was hit exceptionally hard by COVID-19 in the second quarter, we offered a vaccination program for all of our employees and also assisted employees and their families in getting access to medical care when necessary.

For our efforts to provide an attractive workplace, we were named Top Employer Europe for the second time in a row.

We continued to focus on our eight strategic priorities: brand heat, product ranges that are right for our consumers, a comprehensive offer for women, the quality of our distribution, the speed and efficiency of our organizational infrastructure, focus on the North American market by re-entering into basketball and focus on local relevance and sustainability.

To drive brand heat, we signed several new partners such as French DJ and record producer DJ Snake. In Teamsport, we signed long-term agreements with the French national team players Raphaël Varane and Kingsley Coman. We also partnered with NHL All-Star Leon Draisaitl, who will become the first NHL ice hockey player to join the company as a brand ambassador for training and fitness. In Basketball, we were joined by the most valuable player in the WNBA Breanna “Stewie” Stewart and PUMA player LaMelo Ball was voted Rookie of the Year in the NBA.

Signing some of the best athletes and teams in the world gives PUMA credibility as a sports brand and makes it stay true to its roots in performance. The success of our athletes and teams also reflects positively on us as a brand and improves our brand heat.

PUMA team Italy won the UEFA Euro 2020, which was held in 2021, and with Giovanni Di Lorenzo, Giorgio Chiellini, Harry Maguire, Kyle Walker and Jordan Pickford we had five players wearing PUMA’s latest football boots in the final. All four PUMA federations (Austria, Czech Republic, Italy and Switzerland) had progressed to the knock-out stages and we had three teams in the quarterfinals - more than any other sports brand.

On a club level, Manchester City won the Premier League for the third time in four years and reached the Champions League final. In Germany, Borussia Dortmund won the DFB Cup and our Brazilian team Palmeiras won the Copa Libertadores. We also signed additional top clubs including Fenerbahce Istanbul in Turkey or Shakhtar Donetsk in Ukraine.

In track and field, PUMA athlete Karsten Warholm made history when he broke the 29-year-old 400m hurdles World Record, wearing PUMA’s new EvoSPEED Future FASTER+ spike, which we developed together with Formula 1 team MERCEDES AMG PETRONAS. Karsten’s success adds to the list of track and field World Records set in PUMA performance footwear: Men 100m, 200m (both Usain Bolt, Jamaica), 1000m (Noah Ngeny, Kenya), 3000m steeple chase (Saif Shaheen, Qatar), triple jump (Jonathan Edwards, GB), pole vault (Armand “Mondo” Duplantis, Sweden) and now 400m hurdles. Our highly innovative performance products and the roster of world-leading athletes make us look forward to this year’s Summer Olympics in Tokyo. We will have 13 PUMA-sponsored federations and more than 200 individual athletes from 35 different countries in track and field as well as many more athletes in other sports competing in Tokyo this summer.

In Golf, PUMA player Bryson DeChambeau won the Arnold Palmer Invitational in March, while in Motorsport, PUMA teams Red Bull Racing Honda and MERCEDES AMG PETRONAS are dominating the season.

To amplify the successes of our athletes and to spread a message of hope, optimism and self-belief, following what many consider to be one of the most challenging years, PUMA launched the ONLY SEE GREAT campaign. As part of this campaign, which is inspired by cultural icon, entrepreneur and philanthropist Shawn “JAY-Z” Carter, PUMA ambassadors such as Neymar Jr. have told their story of how they achieved greatness in a series of media interviews and content on PUMA’s digital channels.

On the product side, we presented a completely new line-up of performance running shoes featuring our cushioning technology NITRO. The DEVIATE, DEVIATE ELITE, VELOCITY, LIBERATE, and ETERNITY offer an effortless run and received very positive reviews from runners and the media alike.

Our PUMA classics continued to resonate well with consumers in line with the retro trend in the market. One of our latest styles for women, the MAYZE also took inspiration from the past and mixed it with modern elements and playful colors. The MAYZE is worn by the global pop star Dua Lipa and selling very well across all key markets.

We reiterated our commitment to creating a leading product offer for women with our SHE MOVES US platform. SHE MOVES US brings together our top female brand ambassadors such as Dua Lipa, Cara Delevingne, Magdalena Eriksson and Jodie Williams to celebrate the women who have moved culture and sports forward and inspire other women around the world. As part of SHE MOVES US, PUMA also teamed up with “Women Win”, an organization which gives women and girls around the world the possibility to compete in sports. In June, PUMA announced that it would have its own team in the W Series, the international motor racing championship for female drivers only.

We took an important step towards strengthening our distribution and logistics network by starting operations at our new logistics center in Geiselwind, Germany. The center is being ramped up gradually and we expect it to be fully operational towards the end of 2021. We also increased the reach of our Direct to Consumer business by launching new PUMA.com stores in the United Arab Emirates and Mexico.

In the first half of 2021, the pandemic impacted different regions differently. This once again affirmed our belief in local relevance and local decision-making, giving local management the tools to react quickly to changes in the market they know best.

PUMA continued to establish itself as a credible brand in Basketball, following its re-entry into the sport in 2018, an important move to stay relevant as a sports brand, especially in the North American market. After last year’s success of the RS-DREAMER Basketball sneaker, designed by J.Cole, PUMA launched the RS-DREAMER 2, a mid-silhouette intended to be worn on and off the court. The Basketball business also launched several successful collaborations this year, from nostalgic cartoon Rugrats to popular video game NBA 2K. The next highlight will be the introduction of the LaMelo Ball signature shoe which is planned for Q4 2021.

This year, PUMA announced further steps to make its products and its supply chain more sustainable, both from an environmental and social point of view. With our 10FOR25 sustainability targets, we ensure that whenever our consumers buy a PUMA product, they are buying a sustainably sourced product. That is why we set ourselves the goal of making nine out of ten PUMA products with more sustainable materials by 2025. We also signed an agreement with not-for-profit environmental organization Canopy and committed to protect forests around the world when sourcing paper, cardboard and viscose. We communicate these efforts to our consumers through our FOREVER BETTER platform.

To further strengthen our organization, we have created the new role of Chief Commercial Officer within the Board of Management, increasing the number of board members from three to four. Arne Freundt took on this new role on June 1 and he oversees Sales, including Retail & E-Commerce, and Logistics. Also, effective June 1, Hubert Hinterseher was named as the new Chief Financial Officer, taking over from Michael Lämmermann who retired after 28 years with the company. Hubert is responsible for Finance, Legal, IT and Business Solutions.