Key developments Q1 2025

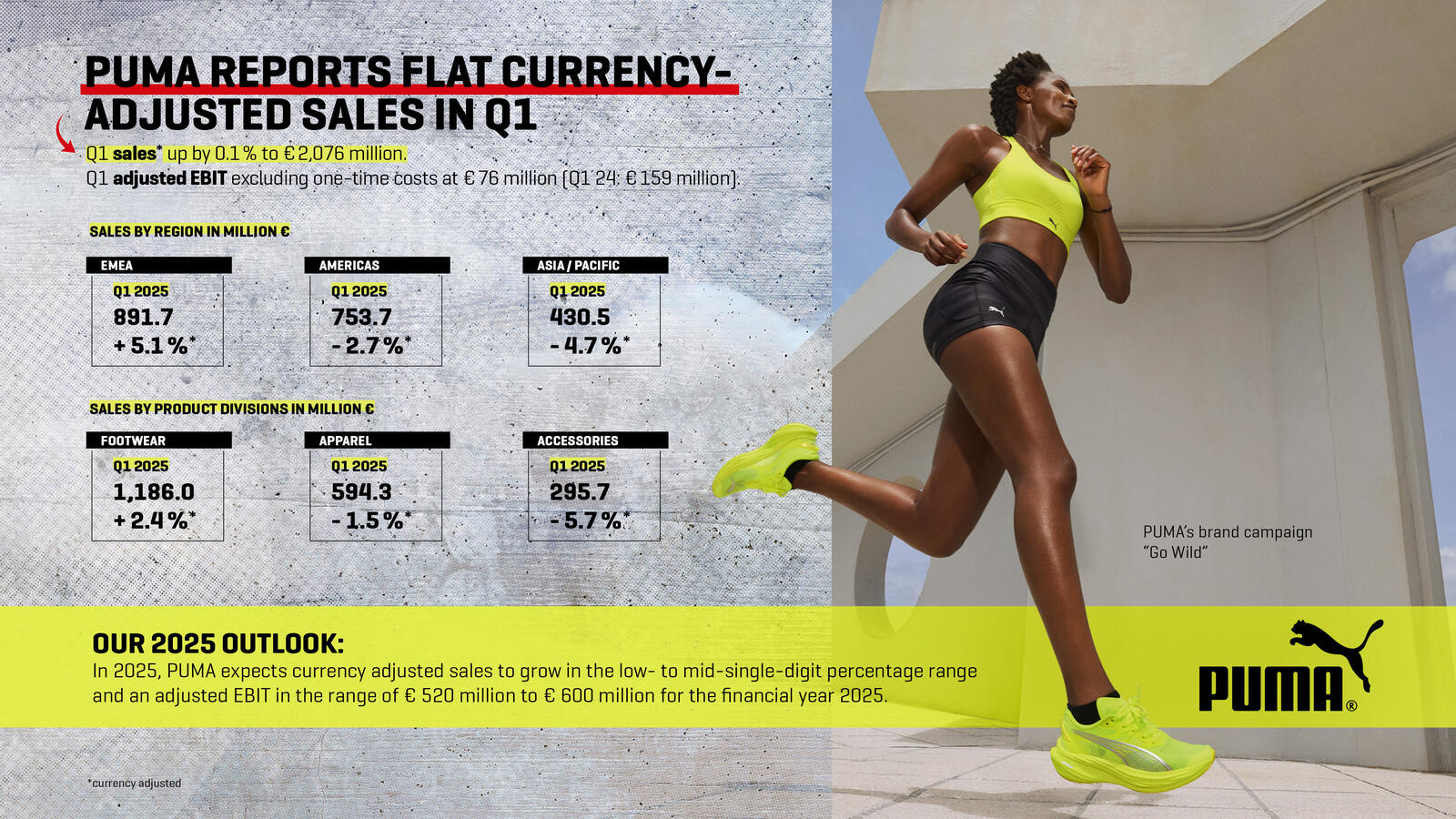

- Currency-adjusted sales up by 0.1% to € 2,076 million (-1.3% reported)

- Gross profit margin decreases by 60 basis points to 47.0%

- Operating expenses (OPEX) increase by 7.1% to € 905 million

- Adjusted EBIT excluding one-time costs decreases by 52.4% to € 76 million

- EBIT at € 58 million, including one-time costs of € 18 million from the nextlevel cost efficiency programme

- Nextlevel Update: Reduction of about 500 staff positions expected to be completed by end of Q2. Efficiency initiatives started for unprofitable owned & operated retail stores, indirect procurement, sourcing and IT

- PUMA appoints Arthur Hoeld as CEO (effective 01 July 2025) and Matthias Bäumer as Chief Commercial Officer (effective 01 April 2025)

Outlook FY 2025

- Currency-adjusted sales growth at low- to mid-single digit percentage rate

- Adjusted EBIT excluding one-time costs in a range between € 520 million and € 600 million

- CAPEX of around € 300 million

- Maintained outlook excludes potential implications from U.S. tariffs announced after PUMA’s initial outlook on 11 March 2025

Markus Neubrand, Chief Financial Officer of PUMA SE:

“In the first quarter and despite a challenging environment, PUMA achieved sales on last year's level in constant currencies. Our Direct-to-Consumer business, driven by e-commerce, grew by 12%, while our wholesale business declined by 4% - primarily because of the U.S. and China. Our adjusted operating profit came in broadly in line with our expectations.

Despite the challenges we had to face in the first quarter, such as a slightly decreasing gross profit margin and higher operating expenses, we remain committed to executing our nextlevel cost efficiency program which is progressing as planned. We are on track to have approximately 500 corporate positions reduced globally by the end of the second quarter 2025.

In the evolving global trade landscape and amidst macroeconomic volatility, we concentrate on controllable factors and diligently serve our retail partners, consumers, and brand ambassadors. Our outlook for the financial year 2025 remains unchanged. Due to the highly uncertain implications from the U.S. tariffs, we are not quantifying the potential implications at this stage. We already reduced U.S. imports from China and we will continue to remain agile and ready to manage the increased market volatility and swiftly respond to changing external conditions.”

First Quarter 2025

Sales grew currency-adjusted (ca) by 0.1% to € 2,076.0 million (-1.3% reported). Sales in the EMEA region increased by 5.1% (ca) to € 891.7 million, driven by double-digit growth in EEMEA. In the Americas region, sales decreased by 2.7% (ca) to € 753.7 million due to a decline in North America, while Latin America recorded double-digit growth during the quarter. Sales in the Asia/Pacific region decreased 4.7% (ca) to € 430.5 million, reflecting ongoing softness in Greater China.

PUMA’s Wholesale business decreased by 3.6% (ca) to € 1,529.5 million. As anticipated, the softness was mainly driven by the U.S. and China. Our Direct-to-Consumer (DTC) business grew by 12.0% (ca) to € 546.5 million, led by the e-commerce business which grew 17.3% (ca), while sales in owned & operated retail stores increased 8.9% (ca). The DTC share rose to 26.3%, up from 23.5% in Q1 2024.

Footwear sales increased by 2.4% (ca) to € 1,186.0 million, driven by the Running, Basketball and Sportstyle categories. Sales in Apparel decreased by 1.5% (ca) to € 594.3 million while Accessories decreased by 5.7% (ca) to € 295.7 million due to Golf.

The gross profit margin decreased by 60 basis points to 47.0% (Q1 2024: 47.5%). Positive inventory valuation effects in the previous year as well as currency effects were a headwind. This was partially offset by tailwinds from sourcing, along with a favourable effect from the product and distribution channel mix.

Operating expenses (OPEX), excluding nextlevel related one-time costs, increased by 7.1% to € 904.9 million (Q1 2024: € 845.3 million). The increase was mainly due to the continued growth of our DTC business, especially e-commerce, and higher depreciation & amortisation (D&A) from investments in DTC and infrastructure. In addition, currency-related headwinds and timing of marketing activities weighed on the OPEX ratio, which increased by 340 basis points to 43.6% (Q1 2024: 40.2%).

Adjusted EBIT, excluding nextlevel related one-time costs, decreased by 52.4% to

€ 75.7 million (Q1 2024: € 159.0 million) due to a lower gross profit margin and higher OPEX. PUMA incurred one-time costs of € 18.0 million in the first quarter as part of its nextlevel cost efficiency programme. These costs were mainly associated with personnel expenses and other one-time non-operating costs. Consequently, the operating result (EBIT) decreased by 63.7% to € 57.7 million (Q1 2024: € 159.0 million) and the EBIT margin came in at 2.8%

(Q1 2024: 7.6%).

The financial result decreased by 56.8% to € -42.0 million (Q1 2024: € -26.8 million) mainly due to higher net interest expenses. Taxes on income amounted to € -4.2 million (Q1 2024:

€ -33.0 million) with a tax rate of 26.5% (Q1 2024: 25.0%) driven by higher withholding taxes and a different profit mix. Net income attributable to non-controlling interests was at

€ -11.1 million (Q1 2024: € -11.8 million).

Consequently, net income came in at € 0.5 million (Q1 2024: € 87.3 million) and earnings per share amounted to € 0.00 (Q1 2024: € 0.58)

Working Capital

The working capital increased by 12.8% to € 2,081.6 million (31 March 2024: € 1,845.7 million). Inventories increased by 16.3% to € 2,076.1 million (31 March 2024: € 1,785.6 million), mainly driven by a strong increase of goods in transit. Trade receivables increased by 5.9% to € 1,517.6 million (31 March 2024: € 1,432.5 million). Trade payables increased by 17.3% to € 1,434.9 million (31 March 2024: € 1,222.8 million), in line with the increase of inventories.

Share Buyback

On 31 March 2025, PUMA completed the acquisition of shares within the framework of the share buyback programme of PUMA SE, which started on 7 March 2024. Under this programme, a total of 2,816,714 shares were repurchased, representing approx. 1.88% of the company's nominal share capital. The average purchase price per share paid on the stock exchange was € 35.50. The total price of the acquired shares amounted to € 100 million (excluding incidental transaction costs).

Brand & Product Update

- PUMA launches “Go Wild”, its biggest brand campaign to date, with a first chapter dedicated to running

- PUMA inspires runners to set new personal bests at the Boston and London Marathon with its fastest-ever racing shoe, the Fast-R NITROTM Elite 3

- PUMA athlete and pole vault world record holder Armand “Mondo” Duplantis wins Laureus World Sportsman of the Year Award

- PUMA becomes official partner of the Premier League, the most-watched football league globally

- PUMA’s Speedcat Ballet, featuring K-pop star Rosé in a global campaign, ranked in the top 3 of the LYST index

- PUMA and HYROX, the world series of fitness racing, launch first joint collection to include co-branded footwear as well as performance apparel

- PUMA reaches goal of making 9 out of 10 products with recycled or certified materials in 2024

Outlook 2025

In a challenging environment, PUMA’s performance for the first quarter of 2025 was broadly in line with expectations. The company continues to focus on its controllables and expects currency-adjusted sales to grow in the low- to mid-single-digit percentage range in the financial year 2025.

PUMA continues to execute the nextlevel cost efficiency programme which is expected to incur one-time costs of up to € 75 million in 2025. These one-time costs are related to the closure of unprofitable owned & operated retail stores, restructuring expenses and other one-time non-operating costs. In return, the company expects to generate additional EBIT of up to € 100 million in 2025.

To better reflect the underlying business performance, the company is providing an adjusted EBIT outlook for 2025, which excludes one-time costs related to the nextlevel cost efficiency programme. Accordingly, PUMA expects an adjusted EBIT in the range of € 520 million to € 600 million for the financial year 2025 (2024: € 622.0 million).

PUMA acknowledges the ongoing changes to the additional U.S. tariffs announced recently. At this stage, the outcome of these developments remains highly uncertain and therefore this outlook does not include potential implications from tariffs announced after PUMA’s initial outlook on 11 March 2025.

PUMA plans to continue investing in its retail store network and e-commerce business, along with warehouse and digital infrastructure, to enable its long-term growth objectives and therefore anticipates capital expenditures (CAPEX) of around € 300 million in 2025 (2024: € 263.0 million).

While the environment remains volatile, the company continues to focus on its controllables. PUMA is committed to addressing short-term challenges while continuing to prioritise investments into the brand and infrastructure as foundation for mid- to long-term success.

Financial Calendar:

21 May 2025 Annual General Meeting

31 July 2025 Interim Report Q2 2025

30 October 2025 Quarterly Statement Q3 2025

The financial releases and other financial information are available on the Internet at “about.puma.com“.