Investor Relations

Share Price in EUR

Sales in € million

EBIT in € million

Employees

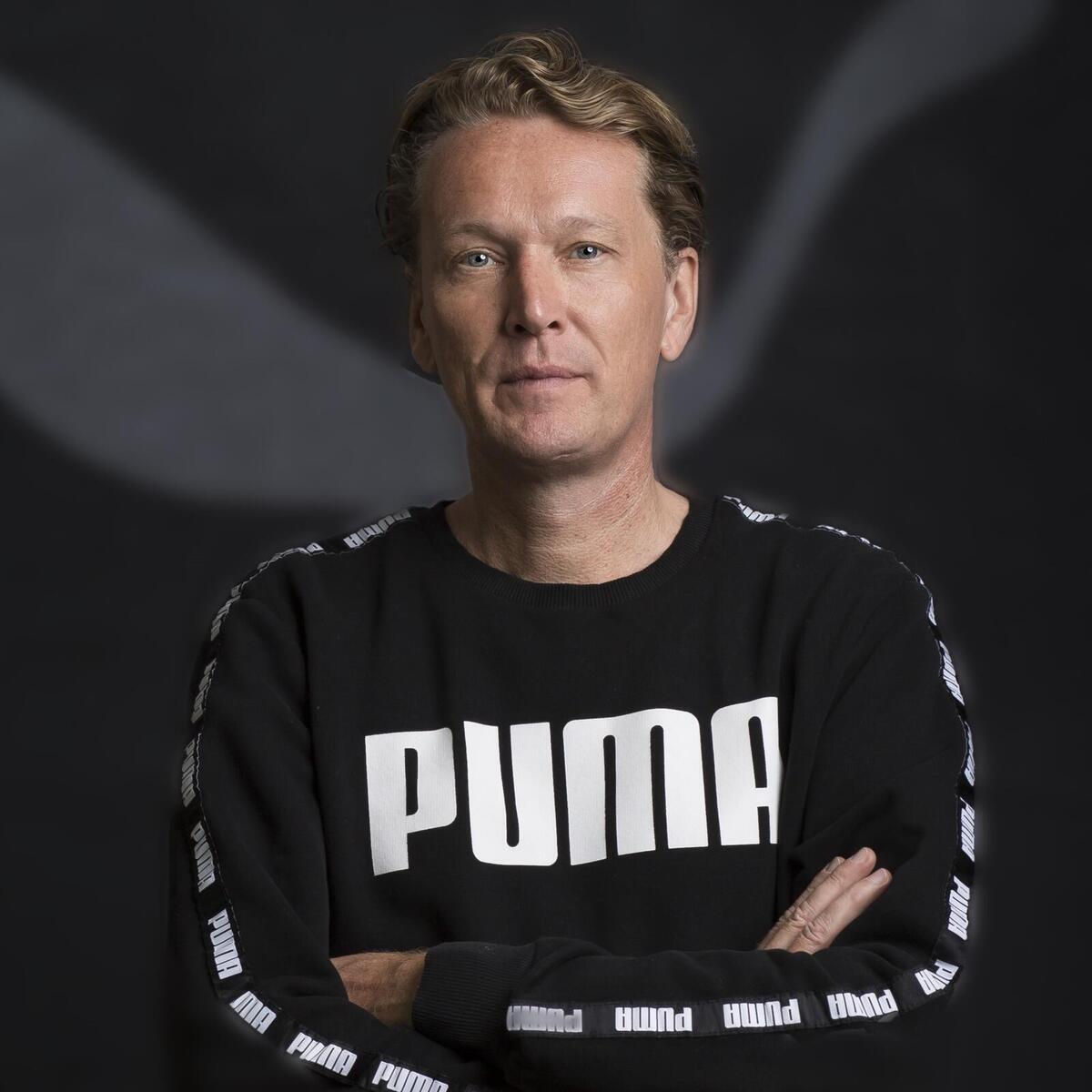

“At the end of July, we stated that 2025 would be a year of reset. Since then, we have taken important steps to clean up PUMA’s distribution, improve our cash management and reset our operational expenses. By expanding our cost efficiency programme, we are moving quickly to address challenges and make the business more efficient and resilient. With third-quarter results meeting our expectations, we remain committed to executing these measures with discipline.

I strongly believe the PUMA brand has incredible potential with more than 77 years of history, one of the best product archives in the industry and huge credibility in many major sports. We have identified the areas in which we need to take decisive action and outlined our strategic priorities to become one global sports brand with globally resonating product ranges and inspiring storytelling across markets. With these strategic priorities, we have the clear ambition to establish PUMA as a Top 3 sports brand globally, returning to above industry growth and generating healthy profits in the medium term.”

Arthur Hoeld

CEO PUMA SE

PUMA SE Q4 & FY 2025 Earnings Call Webcast

Register here for the upcoming PUMA SE Q4 & FY 2025 Earnings Call, hosted by CEO Arthur Hoeld and CFO Markus Neubrand, scheduled for February 26, 2026

Investor News

Sustainability

Across our business, we‘re taking action for people and the planet. We we‘ll never stop holding ourselves accountable and finding ways to do more...

There‘s only one forever – let‘s make it better

Financial Calendar

Our History

PUMA is relentlessly pushing sports and culture forward by creating the fastest products for the world’s fastest athletes. Since 1948, PUMA has drawn strength and credibility from its heritage in sports.