Global sports brand PUMA has signed 22-year-old US-American track and field athlete Abby Steiner. Her victory in the 200-meter final of the US Outdoor Championships in 21.77 seconds makes her the second fastest woman in the world over this distance this year. She will compete at this summer’s World Athletic Championships in Eugene, Oregon, USA.

Abby holds both the women's indoor 200 meters American record as well as the NCAA record (outdoors) and was named nations best high school female athlete in 2018. She holds personal best of 10.90 seconds over 100 meters and 21.77 seconds over 200 meters. Earlier this year, she was named the National Women’s Track Athlete of the Year and the 2022 Honda Sport Award winner for Track & Field.

Just after setting a collegiate record at the NCAA championships in June this year, Abby Steiner won her first national title in the women’s 200 meters in Eugene, Oregon, with a time of 21.77 seconds.

“Abby Steiner is one of the most exciting upcoming stars in Track and Field,” said Pascal Rolling, Head of Running Sports Marketing at PUMA. “We believe that she will have a brilliant career and we want to be by her side and support her.”

“PUMA’s list of high-performance athletes is impressive and being one of them just feels amazing,” said Abby Steiner. “I am very happy to be part of the PUMA family now and I cant wait to take off.”

Global sports brand PUMA has signed five-time Olympic champion and fastest woman alive Elaine Thompson-Herah. The 30-year-old Jamaican will further boost the company’s impressive roster of track and field athletes ahead of the 2022 World Athletics Championships in Eugene, Oregon, USA.

PUMA has a long and rich history in Track & Field and has sponsored the Jamaica Athletics Administrative Association since 2002. Elaine Thompson-Herah now joins her Jamaican compatriot, sprint superhero, world record holder and Olympic gold medalist Usain Bolt.

“PUMA just felt like the right fit, a company that has been working with the World’s Fastest Man for decades,” said Elaine Thompson-Herah. “I’m excited to be part of such an elite group and can’t wait to get started. I really want to break the 100-meter world record. The current one has been undefeated for 34 years. Now is the time. I think there's still a lot I can unleash."

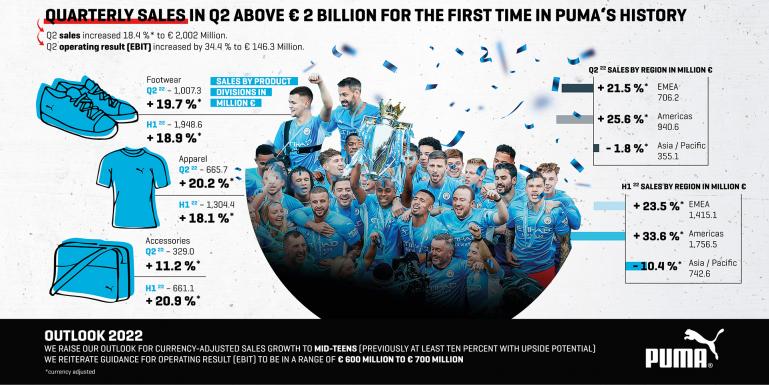

2022 Second Quarter Facts

- Sales increase by 18.4% currency adjusted (ca) to € 2,002 million (+26.0% reported / Q2 2021: €1,589 million)

- Gross profit margin decreases to 46.5% (Q2 2021: 47.5%)

- Operating expenses (OPEX) increase by 21.6% to € 791 million, while OPEX ratio improves

- Operating result (EBIT) improves by 34.4 % to € 146 million (Q2 2021: € 109 million)

- EBIT margin increases by 40 basis points to 7.3% (Q2 2021: 6.9%)

- Net earnings improve by 73.2% to € 84 million (Q2 2021: € 49 million)

- PUMA teams Manchester City and AC Milan win national league titles

- PUMA and AC Milan announce a long-term extension of their partnership

- PUMA and Italian Lega Serie A unveil the new official ball for the 2022/23 season

- PUMA releases four national team home kits for the UEFA Women’s Championship

- PUMA and Breanna “Stewie” Stewart unveil the Stewie 1, the first women’s signature basketball shoe in over a decade

- PUMA and LaMelo Ball release a special edition basketball shoe MB.01 Galaxy

- PUMA and Neymar Jr. launch the Slipstream sneaker campaign, bringing the ‘80s basketball silhouette into the modern age

- PUMA introduces its shopping app in India and kicks off Web3 collaborations with 10KTF and Roblox

- PUMA is ranked most sustainable brand on Business of Fashion Sustainability Index 2022

- Héloïse Temple-Boyer elected as Chair of the Supervisory Board of PUMA SE

2022 Half Year Facts

- Sales increase by 19.0% (ca) to € 3,914 million (+24.7% reported / H1 2021: € 3,138 million)

- Gross profit margin decreases to 46.8% (H1 2021: 48.0%)

- Operating expenses (OPEX) increase by 20.2% to € 1,504 million (H1 2021: € 1,252 million)

- Operating result (EBIT) improves by 30.1% to € 342 million (H1 2021: € 263 million)

- EBIT margin increases by 30 basis points to 8.7% (H1 2021: 8.4%)

- Net earnings improve by 30.3% to € 206 million (H1 2021: € 158 million)

BJØRN GULDEN, CHIEF EXECUTIVE OFFICER OF PUMA SE:

“The second quarter was another great quarter for us. With a currency-adjusted growth of 18% (26% reported) to € 2,002 million, we exceeded € 2 billion in quarterly sales for the first time in PUMA’s history. This underlines the strong demand for our products despite all the global obstacles and uncertainties! I am especially proud that we have again seen very strong growth in all our performance categories like Running, Training, Teamsports, Golf and Basketball. We feel that the increased investments into R&D, Innovation and Product Development over the past years are starting to pay off. Our Gross Margin is currently of course under pressure and declined by 100 basis points to 46.5%, mainly due to an unfavorable geographical and channel mix as well as the higher freight rates. Despite increasing costs, we will continue to focus on keeping our prices competitive and will prioritize sales growth and market share gains above short-term profitability. Due to our strong sales growth we managed to increase our EBIT by 34% from € 109 million in Q2 2021 to € 146 million in Q2 2022 despite increased investments into marketing and sales and higher warehousing costs. We do see an increased level of uncertainty around the world: COVID-19 is still around us, the crisis in Ukraine is worse than ever and there is high inflationary pressure in almost all our markets. Despite all these uncertainties we will continue to invest into our people, brand and infrastructure. We will also continue with our “People First” attitude and do everything we can to ensure the health and safety of all our people, especially in Ukraine. The PUMA Family means more than short-term profitability. I remain optimistic for our sector in general and the PUMA brand in particular and we even raise our revenue outlook for the full year 2022.”

Second Quarter 2022

Sales increased by 18.4% (ca) to € 2,002.0 million (+26.0% reported), representing the highest quarterly sales in PUMA’s history. A continued high demand for the PUMA brand in the Americas region resulted in a strong sales growth of 25.6% (ca). Sales in EMEA were up 21.5% (ca), driven by strong growth across all key markets in Europe. Sales in Asia/Pacific declined 1.8% (ca) due to COVID-19 related lockdown measures in Greater China, while other major markets in Asia/Pacific recorded strong growth. All product divisions grew double-digit with Footwear being up 19.7% (ca), Apparel up 20.2% (ca) and Accessories up 11.2% (ca). In line with previous quarters, growth was driven by continued strong demand for our Performance categories like Running & Training, Teamsports, Golf and Basketball, as well as for the Sportstyle category.

PUMA’s Wholesale business increased by 22.6% (ca) to € 1,563.2 million and the Direct-to-Consumer (DTC) business was up by 5.5% (ca) to € 438.8 million. Sales in owned & operated retail stores increased 11.3% (ca), while e-commerce declined 4.1% (ca), mainly due to lockdown measures in Greater China. We continued to execute our strategy of being the best partner for our retailers and continued to prioritize them over DTC.

The gross profit margin decreased by 100 basis points to 46.5%, mainly caused by an unfavorable geographical and channel mix as well as higher freight rates, while currencies had a positive effect.

Operating expenses (OPEX) increased by 21.6% to € 791.2 million as a result of higher marketing expenses, more retail stores operating as well as higher sales-related distribution and warehousing costs. Despite ongoing operating inefficiencies due to COVID-19, especially in the supply chain, the OPEX ratio decreased to 39.5% (Q2 2021: 40.9%) due to higher sales growth and continued OPEX control.

The operating result (EBIT) increased by 34.4% to € 146.3 million (Q2 2021: € 108.9 million). Strong sales growth and an improved OPEX ratio resulted in an EBIT margin increase by 40 basis points to 7.3% (Q2 2021: 6.9%).

Net earnings increased by 73.2% from € 48.7 million to € 84.3 million and earnings per share were up from € 0.33 in the second Quarter of 2021 to € 0.56 in the second Quarter of 2022.

First Half Year 2022

Sales increased by 19.0% (ca) to € 3,914.1 million (+24.7% reported). Americas led the growth with a 33.6% (ca) increase in sales, followed by the EMEA region, with all key markets in Europe contributing strong growth to a 23.5% (ca) increase in sales. Sales in the Asia/Pacific region were down 10.4% (ca) due to geopolitical tensions and COVID-19 related lockdown measures in Greater China, while other major markets in Asia/Pacific recorded strong growth. All product divisions grew double-digit, with Footwear being up 18.9% (ca), Apparel up 18.1% (ca) and Accessories up 20.9% (ca).

The Wholesale business was up 22.9% (ca) to € 3,091.4 million and the Direct-to-Consumer (DTC) business increased by 6.2% (ca) to € 822.8 million. Sales in owned & operated retail stores increased 15.8% (ca), while e-commerce declined 8.6% (ca). E-commerce was impacted by our continued prioritization of retail partners and the lockdown measures in Greater China.

The gross profit margin decreased by 120 basis points to 46.8% (H1 2021: 48.0%). The decline was mainly caused by an unfavorable geographical and channel mix as well as higher freight rates, partially offset by currencies.

Operating expenses (OPEX) increased by 20.2% to € 1,504.1 million (H1 2021: € 1,251.5 million). Higher marketing expenses, more retail stores operating, higher sales-related distribution and warehousing costs, as well as operating inefficiencies due to COVID-19 contributed to this increase. However, the respective OPEX ratio decreased from 39.9% in the first half of 2021 to 38.4% in the first half of 2022 due to higher sales growth and continued OPEX control.

The operating result (EBIT) increased by 30.1% to € 342.4 million (H1 2021: € 263.2 million) due to a strong sales growth and an improved OPEX ratio. The EBIT margin improved by 30 basis points to 8.7% (H1 2021: 8.4%).

Net earnings increased by 30.3% from € 157.8 million to € 205.6 million and correspondingly earnings per share were up from € 1.06 in the first half of 2021 to € 1.37 in the first half of 2022.

Working Capital

The working capital increased by 54.3% to € 1,067.4 million (June 30, 2021: € 691.9 million). Inventories were up by 42.9% to € 1,984.4 million (June 30, 2021: € 1,388.7 million), which continued to be impacted by higher Goods in Transit. Trade receivables increased by 27.8% to € 1,189.8 million (June 30, 2021: € 931.1 million) mainly as a result of strong sales growth. On the liabilities side, trade payables increased by 30.4% to € 1,657.1 million (June 30, 2021: € 1,270.6 million).

Cash Flow and Liquidity Situation

The free cash flow improved by 57.1% to € 38.6 million in the first half of 2022 (H1 2021: € 24.6 million). As of June 30, 2022, PUMA had cash and cash equivalents of € 498.4 million, a decrease of 34.0% compared to the first half of 2021 (June 30, 2021: € 755.2 million). In addition, the PUMA Group had credit lines totaling € 1,276.9 million as of June 30, 2022 (June 30, 2021: € 1,424.1 million). Unutilized credit lines amounted to € 923.6 million on the balance sheet date compared to € 933.7 million in the first half of 2021.

Brand & Strategy Update

With the ongoing COVID-19 pandemic and the crisis in Ukraine, the first half of 2022 presented PUMA with several challenges that required us to remain flexible and find pragmatic solutions to continue to implement our strategy while taking care of the PUMA Family.

The wellbeing of our employees, athletes and partners in Ukraine was our immediate priority from the start of the crisis. We immediately secured safe accommodation in the west of Ukraine and set up additional housing options for our Ukrainian colleagues and their family members in Germany and Poland. We made sure that our colleagues who had to leave their home country received work permits and jobs in their new residences.

The crisis showed how we came together as a PUMA Family. We were inspired by our PUMAs who waited at the borders to welcome other PUMA employees and ambassadors who had fled Ukraine, as well as by our colleagues who drove to Ukraine to bring necessities such as food and clothes to their colleagues who had stayed in the country.

At our headquarters in Herzogenaurach, we gathered product donations for aid organizations in Ukraine, to get help to those who needed it most. Several pallets of products also departed to Ukraine from our distribution center in Geiselwind.

For our efforts to provide an attractive workplace, PUMA was named a Top Employer 2022 in several regions of the world, including Europe and Asia/Pacific.

While the COVID-19 pandemic eased in Europe and the Americas in the first half of the year and we saw no further widespread store closures there, the situation in parts of Asia, especially in China, was still challenging for our store network and our supply chain. Our sourcing teams did an exceptional job to make sure that supply chain disruptions were kept to a minimum.

In 2022, we continued to implement our eight strategic priorities: brand heat, product ranges that are right for our consumers, a comprehensive offer for women, improving the quality of our distribution, increasing the speed and efficiency of our organizational infrastructure, leveraging our re-entry into basketball to improve our position in North America and to focus on local relevance and sustainability.

The performances of our track and field athletes at the World Indoor Championships in Belgrade, Serbia, and the World Athletic Championships in Eugene, Oregon, USA, underscored our credibility as a sports brand and created brand heat. PUMA enjoyed great visibility by equipping several federations and world-class athletes, in line with the company’s philosophy to provide the fastest athletes with the fastest products.

Among the highlights: In Belgrade, Ukrainian PUMA athlete Yaroslava Mahuchikh won gold in the high jump and created a very special moment at the event, as she won despite the crisis in her home country and the difficult three-day journey she had to make to get from Ukraine to Serbia.

In Eugene, Jamaican sprinter Shericka Jackson ran the second-fastest 200m time in history and in triple jump, Portuguese athlete Pedro Pichardo also won the gold with the performance of the year. Swedish pole vaulter Armand “Mondo” Duplantis added another centimeter to his world record performance and won the gold medal with a leap of 6.21 meters.

Our PUMA family continued to grow in the first half. In track and field, we signed a multi-year contract with the Brazilian Confederation of Athletics (CBAt).

But those were not the only performances that boosted our brand heat: in Football, our PUMA teams AC Milan and Manchester City both won the title and Olympique de Marseille and Borussia Dortmund came in second in their respective leagues. PSV Eindhoven won the Dutch Cup.

At the end of the season, we secured a long-term extension to our partnership with AC Milan and became the official naming partner of the club’s training center for future talents, which will be called the “PUMA House of Football.”

We also expanded our reach in Football, as we became the official match ball provider of the Italian football league Serie A, starting from the 2022/23 season.

In North America, PUMA basketball athlete Marcus Smart was named NBA Defensive Player of the Year, while PUMA ambassador and ice hockey player Leon Draisaitl set an NHL record for most assists in a single playoff series. In Golf, Cobra PUMA Golf athlete Ewen Ferguson secured his first victory on the DP WORLD TOUR by winning the Commercial Bank Qatar Masters.

In Motorsport, we welcomed the British Mercedes AMG Petronas F1 driver George Russell and the Alfa Romeo F1 Team ORLEN, including Finnish veteran Valtteri Bottas and Chinese rookie Zhou Guanyu.

As we continued to outfit the most successful teams in Formula 1, Scuderia Ferrari, Red Bull Racing and Mercedes, we also benefited from the increasing popularity of the sport, especially in the United States, where the inaugural Miami Grand Prix was completely sold out in record time.

Through our new partnership with the five-time World Chess Champion Magnus Carlsen and Meltwater Champions Chess Tour, PUMA connected the world of chess with the world of sport to create engaging content and activations for chess fans around the world.

We engaged with our consumers in the virtual world, by announcing our largest collaboration in the Web3 space to date with 10KTF, an NFT project where users can buy digital outfits. We also worked with Wonder Works Studio to create “PUMA and the Land of Games” on the online gaming platform Roblox and gave players the opportunity to dress their virtual characters in PUMA gear.

PUMA further strengthened its distribution by entering new markets with the PUMA.com online store in Saudi Arabia and the Philippines. To highlight the best of the PUMA brand and be close to our most loyal consumers, PUMA introduced a shopping app for smartphones on the Indian market, which allows consumers to virtually try on selected products before they buy, see what the products look like in sophisticated 3D animations and purchase PUMA products in an efficient and quick check out process. The app will be gradually rolled out to other markets.

As we have a vast archive at our disposal, our designers can take inspiration from more than 70 years of history to create fashion forward and relevant products for our customers. With the Slipstream, which was introduced by our Ambassadors Neymar Jr, Danna Paola and Romeo Beckham in June, PUMA brought back the classic design from the 1980s to make a clean and modern sneaker. A collection with Australian skate label Butter Goods also used archive-inspired styles and featured apparel with retro-inspired designs and prints.

Together with French fashion brand AMI, we designed an exclusive collection that combined tailoring and innovative sportswear design with minimalistic branding. We elevated our Motorsport offering with our partner Ferrari to create the premium ION F sneaker and we celebrated the 50th anniversary of the Porsche 911 RS 2.7 car with a limited edition of our classic SUEDE, which was sold out in hours.

New additions to our women’s offering included the Kosmo Rider, an expansion of the Rider franchise in bold colors and a chunky shape, which was promoted by social-media star and music artist Dixie D’Amelio. PUMA also presented a range of leak-free period underwear and activewear with Australian apparel company Modibodi, which was created to help women stay comfortable and active during their period.

In basketball, we added new styles to LaMelo Ball’s signature collection MB.01, such as the MB.01 Galaxy and a special edition on the animated series “Rick and Morty”, which became one of our most sought-after sneakers of 2022. We also welcomed the No. 2 overall pick from the 2022 WNBA draft NaLyssa Smith to our roster of PUMA Hoops athletes.

As local relevance continues to be an important part of our strategy to reach audiences in different parts of the world, we signed pop stars Eleni Foureira from Greece and Teodora from Serbia as brand ambassadors.

We entered a new category with the launch of a PUMA padel collection, including rackets, footwear, apparel and accessories, and signed padel players Jerónimo ‘Momo’ González, Victoria Iglesias, Marco Cassetta, and Xènia Clascà. We also continued to increase the number of locally developed products for the different regions, especially in the Sportstyle category.

In the first half of 2022, we made progress with our Forever Better sustainability strategy, especially when it comes to circularity. Our RE:SUEDE project, which tests whether we can make a biodegradable version of our iconic SUEDE sneaker, entered an important phase, as we distributed 500 pairs to participants in Germany and brand ambassadors such as Cara Delevingne, Raphaël Varane and Kyle Kuzma. After wearing them for half a year, our testers will return the sneakers to PUMA so we can see whether the RE:SUEDEs can be biodegraded in a controlled industrial setting.

We also introduced the RE:JERSEY recycling project with our football teams Manchester City, AC Milan, Borussia Dortmund, Olympique de Marseille and Girona. In this project, we use existing football jerseys to produce new ones, in a chemical recycling process where we can even take old garments that feature logos, embroideries and club badges to create polyester yarn for new jerseys. Other more sustainable products included a vegan version of our classic KING football boot, the KING Platinum 21 Vegan.

In May, we announced that we had cut our own carbon emissions and those coming from our supply chain between 2017 and 2021, even though the business grew strongly in the same period. We are on track to reduce emissions by what scientists say is necessary to avoid the worst consequences of climate change.

Part of our strategy to reduce carbon emissions is to switch to electric vehicles. At our warehouse in Torrance, California, USA, for example, we started transferring goods from the port of Los Angeles with a fully electric truck.

For our sustainability efforts, we were ranked as the most sustainable brand in the industry according to publication Business of Fashion, which evaluated the 30 largest companies in the fashion business.

In terms of organization, the Supervisory Board of PUMA SE has elected Héloïse Temple-Boyer as Chair of the Supervisory Board at its meeting in April. Héloïse Temple-Boyer has been a member of the Board since 2019 and is a member of the Audit Committee.

Outlook 2022

PUMA performed very well in the first half of the year 2022. Based on continued brand momentum, successful product launches with strong sell-through and the best possible service to our retail partners and consumers, we delivered strong sales and EBIT growth.

While the first half of the year has been strong, we continue to face increasing geopolitical and macroeconomic uncertainties and challenges. The ongoing COVID-19-related restrictions, particularly in Asian markets, the crisis in Ukraine and persistently high inflation are negatively impacting consumer confidence and demand. In addition, ongoing supply chain constraints and price increases in sourcing and freight are limiting product availability and putting pressure on margins.

Considering the strong first half of the year, PUMA is raising its outlook from previously at least ten percent currency-adjusted sales growth – with upside potential – to mid-teens currency-adjusted sales growth. Due to the increased uncertainties, we reiterate our operating result (EBIT) to be in a range of € 600 million to € 700 million for the financial year 2022 (2021: € 557 million) and a corresponding improvement in net earnings. The development of our gross profit margin and OPEX-ratio will continue to depend largely on the extent and duration of the negative impacts described above. We expect inflationary pressures from higher freight rates and raw material prices, as well as operational inefficiencies due to COVID-19 and the Ukraine crisis, to dilute our profitability in 2022.

As in previous years, PUMA will continue to focus on managing the short-term challenges without hindering the mid-term momentum and will prioritize sales growth and market share gains over short-term profitability. The strong and profitable growth in the first half of the year, a strong orderbook, an exciting product line-up as well as very good feedback from retailers and consumers make us confident for the mid-term success and growth of PUMA.

Sports company PUMA will discuss solutions for some of the fashion industry’s most pressing sustainability challenges such as waste, materials and climate change at a global event in September.

Taking place in London on September 6 and streamed worldwide, Conference of the People will feature PUMA’s industry peers, activists, NGOs, experts, ambassadors and consumers, who will discuss tackling waste, using more sustainable materials, stopping climate change, protecting forests and finding ways for the industry to collaborate to achieve results sooner.

“We will focus on Gen Z during this event, as we want to give this generation a voice when it comes to the decisions that have to be made today to shape a more sustainable future,” said Bjørn Gulden, CEO of PUMA. “At the United Nations they call it Conference of the Parties, we call it Conference of the People.”

Ahead of the event, PUMA launched the platform PUMACOP.com, where users can learn more about the event and register their interest to attend. The event will also be streamed live on this platform.

International actress, model and activist Cara Delevingne will host the event alongside PUMA CEO Bjørn Gulden and PUMA CSO Anne-Laure Descours.

“Together with PUMA, I have worked on sustainability topics for several years and together we have launched more sustainable collections such as Exhale,” said Cara Delevingne. “It is important to continue the debate about this topic so we can find solutions to environmental issues such as climate change, waste management and biodiversity.”

Becoming more sustainable as a company has been an important pillar of PUMA’s strategy for many years. Earlier this year, the company announced that it had reduced its carbon emissions between 2017 and 2021 from both its own operations (-88%) and its supply chain (-12%), in spite of strong sales growth in the same period. By 2025, PUMA aims to make nine out of 10 products with more sustainable materials.

The company was the most sustainable brand in the industry according to the latest ranking by Business of Fashion, which analyzed the 30 largest companies in the fashion business.

Conference of the People will start on September 6 at 12pm BST (1pm CET, 7 am ET) at Protein Studios in Shoreditch, London for 225 invited guests. The livestream of the event is free to access for all.

At 26 years old, Woo Sanghyeok already has several medals to his name such as gold at the World Indoor Championships in Belgrade and silver at the World Athletics Championships in Eugene. In 2022, he set a personal best and the Korean Record of 2.36 meters at the indoor event in Hustopeče, Czech Republic.

“We are very excited to welcome Sanghyeok to the PUMA family,” said Pascal Rolling, Head of Sports Marketing at PUMA. “We believe he will be among the best high jumpers in the world in the next years.”

At PUMA, Woo Sanghyeok will join a roster of world-class athletes such as 400m hurdles World Record Holder Karsten Warholm, pole vault World Record Holder Armand “Mondo” Duplantis and Jamaican sprinters Shericka Jackson and Elaine Thompson-Herah.

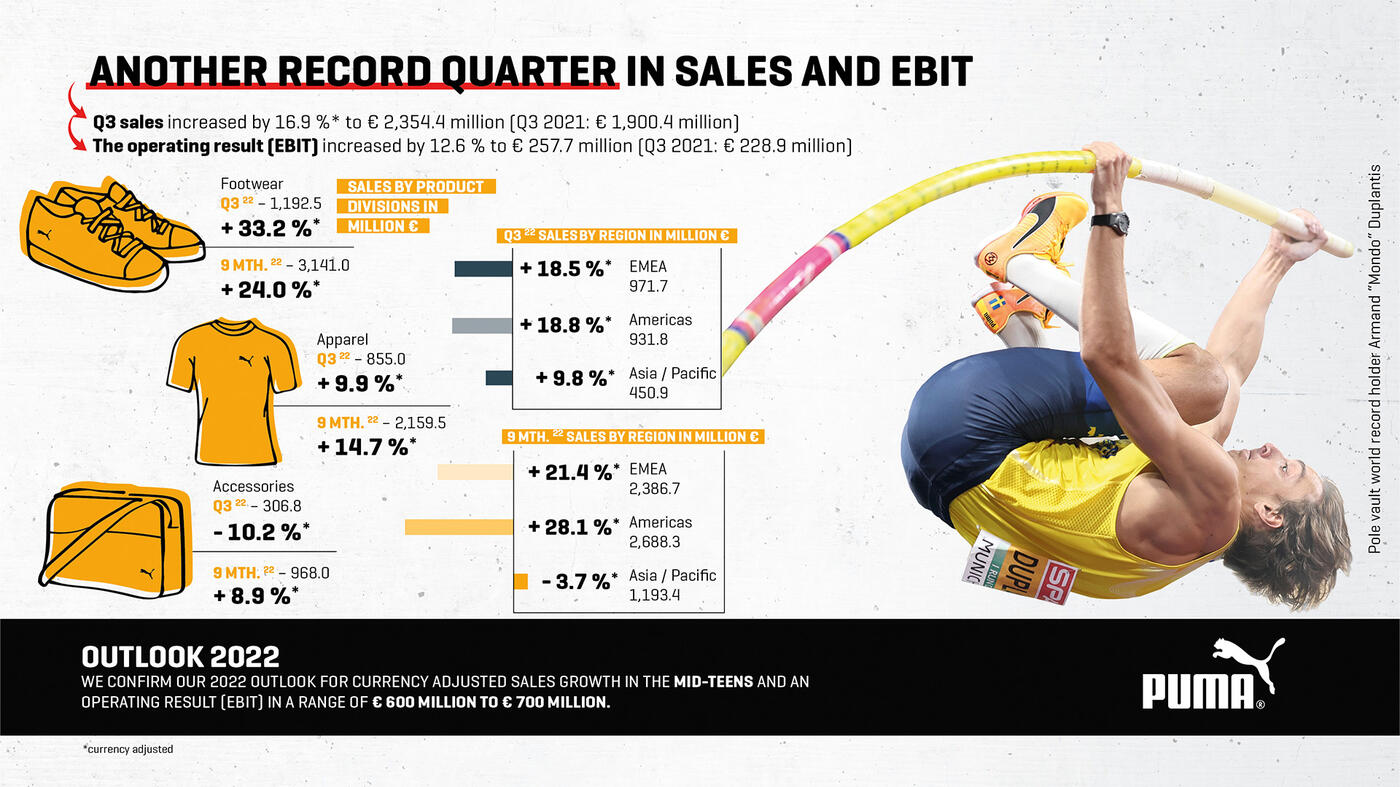

2022 Third Quarter Facts

- Sales increase by 16.9% currency adjusted (ca) to € 2,354 million (+23.9% reported / Q3 2021: € 1,900 million)

- Gross profit margin decreases to 46.8% (Q3 2021: 47.4%)

- Operating expenses (OPEX) increase by 25.8% to € 853 million (Q3 2021: € 678 million)

- Operating result (EBIT) improves by 12.6% to € 258 million (Q3 2021: € 229 million), resulting in an EBIT margin of 10.9% (Q3 2021: 12.0%)

- Net earnings improve by 1.8% to € 146 million (Q3 2021: € 144 million)

- PUMA and Manchester City host their first-ever metaverse jersey launch on Roblox to unveil the new 3rd kit for 2022/23

- PUMA and WNBA star Breanna “Stewie” Stewart launch the Stewie 1, the first new women’s signature basketball sneaker in over a decade

- PUMA presents LaMelo Ball's second signature shoe MB.02 following the sell-through success of the MB.01

- PUMA athletes win medals and set records at World and European Athletics Championships

- PUMA extends its roster of world class track & field athletes by signing Elaine Thompson-Herah, Abby Steiner, Emmanuel Korir and Mutaz Essa Barshim

- PUMA launches SEASONS, an elevated outdoor collection

- PUMA’s FUTROGRADE show at New York Fashion Week blends past and present of the brand in virtual and real-life spectacle

- PUMA announces a long-term partnership with Skepta, a British-Nigerian rapper and record producer

- PUMA hosts Conference of the People, a global event to discuss solutions for a more sustainable fashion industry

2022 Nine Months Facts

- Sales increase by 18.2% (ca) to € 6,269 million (9M 2021: € 5,038 million)

- Gross profit margin decreases to 46.8% (9M 2021: 47.8%)

- Operating expenses (OPEX) increase by 22.2% to € 2,357 million (9M 2021: € 1,930 million)

- Operating result (EBIT) improves to € 600 million (9M 2021: € 492 million), resulting in an EBIT margin of 9.6% (9M 2021: 9.8%)

- Net earnings improve to € 352 million (9M 2021: € 302 million)

BJØRN GULDEN, CHIEF EXECUTIVE OFFICER OF PUMA SE:

“Despite all the global uncertainties the third quarter was again a very good quarter for us. With sales being up 24% in Euro terms at € 2,354 million and EBIT up 13% to € 258 million, it was the best quarter in PUMA’s history. Improved product availability due to a more stable supply chain, better than expected sell-through and PUMA’s continued global brand momentum overcompensated all the negative external factors. During the first nine months, we achieved sales growth of 24% in Euro terms (18% ca) to € 6,269 million and an EBIT of € 600 million.

Our Performance categories like Running, Soccer and Basketball continue to do very well. We still see strong demand for Footwear, but we also observe that high inventory levels in the market, especially for Apparel, have led retailers to order more cautiously than a year ago.

With almost all our markets up double-digit, we continue to see a strengthening of the PUMA brand and our sales globally.

We expect continued volatility in the market during the fourth quarter but are confident that we can deliver according to our full-year outlook.

We will also continue with our people-first approach and always prioritize the health and safety of our employees and not save on anything. At the moment, this is especially true for our people and their families in Ukraine who have our full sympathy and support. At the same time, we will also continue to invest in our people, brand and infrastructure, as sales growth and higher market shares will be more important than short-term profit optimization.”

Third Quarter 2022

Sales increased by 16.9% (ca) to € 2,354.4 million (+23.9% reported), representing the highest quarterly sales in PUMA’s history. The Americas region recorded a strong sales growth of 18.8% (ca). Sales in EMEA were up 18.5% (ca), driven by strong growth across almost all key markets in Europe. The Asia/Pacific region recorded sales growth for the first time this year (+9.8% ca). While COVID-19 related lockdown measures still impacted the business in Greater China, other key markets in Asia/Pacific delivered strong growth. Sales in Footwear were up 33.2% (ca) and Apparel grew 9.9% (ca), driven by continued strong demand for our Performance categories like Running & Training, Teamsports and Basketball, as well as for Sportstyle. Sales in Accessories were down 10.2% (ca) because of a softer leg- and bodywear-business, especially in North America.

PUMA’s Wholesale business increased by 19.9% (ca) to € 1,864.6 million and the Direct-to-Consumer (DTC) business was up by 6.5% (ca) to € 489.7 million. Sales in owned & operated retail stores increased 4.2% (ca) and e-commerce increased 11.8% (ca). We continued to focus on our strategy of being the best partner for our retailers, which supported the strong growth in our Wholesale distribution channel. At the same time, better product availability led to stronger growth in DTC, predominantly in e-commerce.

The gross profit margin decreased by 60 basis points to 46.8%, mainly caused by higher sourcing prices due to raw materials and freight rates as well as an unfavorable channel mix, while price adjustments and currencies had a positive impact.

Operating expenses (OPEX) increased by 25.8% to € 853.2 million as a result of higher marketing expenses, a higher number of retail stores in operation as well as higher sales-related distribution costs. Because of ongoing operational inefficiencies due to COVID-19, especially in supply chain and warehousing, the OPEX ratio increased to 36.2% (Q3 2021: 35.7%).

The operating result (EBIT) increased by 12.6% to € 257.7 million (Q3 2021: € 228.9 million) and the EBIT margin came in at 10.9% (Q3 2021: 12.0%).

Net earnings increased by 1.8% to € 146.4 million (Q3 2021: € 143.8 million), reflecting a decrease in the financial result due to currency effects. Consequently, earnings per share amounted to € 0.98 (Q3 2021: € 0.96).

Nine Months 2022

Sales increased by 18.2% (ca) to € 6,268.5 million (+24.4% reported). Americas led the growth with a 28.1% (ca) increase in sales, followed by the EMEA region with all key markets in Europe contributing strong growth to a 21.4% (ca) increase in sales. Sales in the Asia/Pacific region were down 3.7% (ca) due to geopolitical tensions and COVID-19 related lockdown measures in Greater China, while other major markets in Asia/Pacific recorded strong growth. All product divisions delivered a solid growth, with Footwear being up 24.0% (ca), Apparel up 14.7% (ca) and Accessories up 8.9% (ca).

The Wholesale business was up 21.8% (ca) to € 4,956.0 million and the Direct-to-Consumer business (DTC) increased by 6.4% (ca) to € 1,312.5 million with growth in owned & operated retails stores (+11.1% ca) and a decline in e-commerce (-2.1% ca).

The gross profit margin decreased by 100 basis points to 46.8% (9M 2021: 47.8%). This was mainly caused by an unfavorable geographical and channel mix as well as higher sourcing prices due to raw materials and freight rates, which were partially offset by currencies and price adjustments.

Operating expenses (OPEX) increased by 22.2% to € 2,357.3 million (9M 2021: € 1,929.5 million). Higher marketing expenses, a higher number of retail stores in operation, higher sales-related distribution and warehousing costs, as well as operational inefficiencies due to COVID-19 contributed to this increase. However, the respective OPEX ratio decreased to 37.6% (9M 2021: 38.3%) as a result of higher sales growth and continued OPEX control.

The operating result (EBIT) increased by 22.0% to € 600.1 million (9M 2021: € 492.1 million) due to strong sales growth and continued OPEX control. Consequently, the EBIT margin came in at 9.6% (9M 2021: 9.8%).

Net earnings increased by 16.7% to € 352.1 million (9M 2021: € 301.7 million) and earnings per share were € 2.35 (9M 2021: € 2.02).

Working Capital

The working capital increased by 86.2% to € 1,339.0 million (September 30, 2021: € 719.0 million). Inventories were up by 72.3% to € 2,350.2 million (September 30, 2021: € 1,363.9 million). The current inventory level is strongly impacted by currency effects, higher raw material prices and freight rates as well as earlier product purchasing. In addition, the third quarter last year was comparably low due to COVID-19 related factory closures in South Vietnam. Trade receivables increased by 21.9% to € 1,290.3 million (September 30, 2021: € 1,058.6 million), mainly as a result of strong sales growth. On the liabilities side, trade payables increased by 50.5% to € 1,810.2 million (September 30, 2021: € 1,202.8 million).

Outlook 2022

PUMA achieved record sales and EBIT in the first nine months of 2022 based on continued brand momentum, successful product launches and the best possible service to our retail partners and consumers.

While the first nine months of the year have been strong for PUMA, we continue to navigate in a highly uncertain geopolitical, macroeconomic and competitive environment. The situation in Ukraine, a global energy crisis, persistent inflation and rising interest rates are leading to uncertain consumer behavior and volatile demand. COVID-19-related restrictions are still impacting business in Greater China, and higher freight rates and raw material prices continue to put pressure on margins. At the same time, the overall inventory levels have increased at both retailers and brands. The higher inventory levels, combined with uncertainty and volatility in the markets, are leading to increased promotional activity and retailers ordering later and more conservatively.

Despite the highly uncertain environment, PUMA reiterates its 2022 outlook for currency adjusted mid-teens sales growth, and an operating result (EBIT) in a range of € 600 million to € 700 million (2021: € 557 million). PUMA’s net earnings are expected to improve accordingly. The development of the gross profit margin and OPEX-ratio will continue to depend largely on the extent and duration of the negative impacts described above. In line with previous expectations, PUMA estimates that inflationary pressures from higher freight rates and raw material prices, as well as operational inefficiencies due to COVID-19 and the Ukraine crisis will dilute the profitability in 2022.

In line with the strategy, PUMA will continue to focus on managing short-term challenges without compromising the mid-term momentum of the brand. Consequently, sales growth and market share gains will have priority over short-term profitability. The strong and profitable growth in the first nine months of the year, a strong order book, an exciting product line-up as well as very good feedback from retailers and consumers make us confident for the mid-term success and growth of PUMA.

Sports company PUMA was named Company of the Year at this year’s German Diversity Awards for its commitment to an open and tolerant work environment for its employees.

In line with PUMA’s employer value “Be You”, all employees can be themselves, regardless of their gender, nationality, ethnicity, religion, disabilities, age, or sexual orientation.

“It is important for us that our employees do not bring an office personality to work, but we want them to feel comfortable with us as they are,” says Dietmar Knoess, Global Director of People and Organisation at PUMA. “We are delighted to accept the German Diversity Award and will use it as an incentive to further stress the importance of diversity and inclusion in our company.”

Employees in leadership positions at PUMA are regularly trained in topics such as diversity, intercultural communication and inclusion and there are regular events on the topic of Diversity, anti-discrimination and equality.

This year’s summer festival for the company’s employees in Herzogenaurach, for example, was organized, together with the organization Chrisopher Street Day Nürnberg e.V. in order to celebrate Pride Month, diversity and inclusion.

PUMA sees the diversity of its employees is an asset: at the headquarters in Herzogenaurach, the employees come from over 70 companies and the percentage of women in leadership positions company-wide lies at 44%.

“We are delighted to award PUMA with the Germany Diversity Award 2022 in the category ‘Company of the Year’,” says Victoria Wagner, CEO and founder of BeyondGenderAgenda, the organization which awards the German Diversity Award. “Through its outstanding commitment

to diversity, PUMA was convincing in all voting rounds and is a positive example for embedding diversity practices into its business.”

The Supervisory Board of PUMA SE has today appointed Arne Freundt as chairman of the Management Board and CEO of the Company.

He is receiving a contract for four years, effective January 1, 2023. Arne Freundt has worked for PUMA for more than ten years and has been a member of the Management Board as Chief Commercial Officer since June 2021. Bjørn Gulden’s mandate as member of the Management Board of PUMA SE expires at the end of 2022.

The Supervisory Board of PUMA SE has decided that Arne Freundt, PUMA’s Chief Commercial Officer, will become Chairman of the Management Board and CEO of PUMA SE with immediate effect, after it was announced that Bjørn Gulden will become CEO of Adidas AG.

PUMA announced last week that Bjørn Gulden’s mandate as member of the Management Board of PUMA SE would expire at the end of 2022.

“PUMA’s long-standing relationship with Foot Locker has played an instrumental role in our ability to drive innovation and push the boundaries of sports, fashion, and technology globally,” said Bob Philion, President of PUMA North America. “Our enhanced partnership not only provides us with additional opportunities for collaboration and growth, but it will enable us to provide even greater experiences and inclusion for our evolving customer base around the world.” Through this strengthened partnership, PUMA and Foot Locker have planned a series of exclusive collections and product collaborations with highly influential ambassadors reaching Gen Z and Gen Alpha. Specifics include:

- expanding the basketball and classics categories with continued exclusive access to the LaMelo Ball Signature program, which launched with the MB.02 in October with additional iterations launching later this month and in December;

- launching the first-ever PUMA x POKÉMON collaboration. PUMA and Foot Locker Inc. are partnering with The Pokémon Company International and Niantic, publisher of the popular Pokémon GO mobile game, to turn, for the next six months, 400 Foot Locker, Champs Sports, and Kids Foot Locker stores across the U.S. and the PUMA NYC Flagship store into Gyms and Poké Stops in Pokémon GO. Foot Locker, Champs Sports & Kids Foot Locker are the exclusive destination in North America for the PUMA x POKÉMON collaboration, available now.

- PUMA x PAW PATROL™, a new collection of playful and sporty styles for kids will be available at exclusively at Kids Foot Locker and Foot Locker in North America starting November 25.

- creating and launching upcoming athlete capsules with Mikey Williams;

- building exclusive product programs to be released in the coming months with social media star and music artist Dixie D’Amelio and hip-hop artist Cordae;

- launching PUMA x CoComelon, a new collaboration coming out next Spring and inspired by CoComelon’s favorite characters, which will create a close connection with the younger generation available exclusively at Kids Foot Locker.

“We are very excited to build on our already strong partnership with PUMA,” said Andrew Gray, Executive Vice President, Global Lockers and Champs Sports, Foot Locker, Inc. “By expanding and strengthening our collaboration with PUMA, we continue to advance our strategy to diversify our product selection and bring new and innovative products to our consumers.” In addition to building hyper-relevant creative partnerships and product collections, PUMA and Foot Locker will continue to advance shared marketplace opportunities, which include:

- adding hype drops and marketplace exclusivity through franchises, such as the RSX, shared marketing partnership investments, and elevated in-store and online experiences for PUMA and Foot Locker customers;

- Investing in product creation and marketing to help support Foot Locker’s Leading Education & Economic Development (LEED) Initiative, the company’s commitment to invest in, amplify, and empower the Black community, and PUMA’s REFORM platform to drive social change.

PUMA and Foot Locker have jointly supported a portfolio of ambassadors, athletes, and brands to create exclusive product concepts and market activations across the Foot Locker portfolio. This collaboration has brought together product, marketing, digital, and customer experience in innovative new ways including launches such as L.O.L Surprise.

Shop the latest PUMA collections now at Foot Locker.